[摘REUTERS]

============================================================

Foreigners Gobble Up U.S. Assets

January 16, 2004 11:23:00 AM ET

NEW YORK (Reuters) - Foreigners' net purchases of U.S. assets were a surprisingly large $87.6 billion in the month of November, up steeply from a revised $27.8 billion of net inflows in October, U.S. Treasury Department data showed on Friday.

This staggeringly big inflow -- more than double what most analysts had expected -- delivered a clear bounce to the dollar. The dollar gained about half a cent against the euro soon after the data's release, and rose 1 percent against the Swiss franc in its aftermath.

The dollar showed a ``Total positive reaction to the flows data. It was almost instantaneous. The private accounts showed a big turnaround. This more than covers the huge (current account) deficit that we run because this is such a huge number This is very, very dollar positive. The euro is now bouncing at support of $1.2450.'' said Grant Wilson, vice president at Mellon Bank in Pittsburgh.

With the wide U.S. current account deficit weighing heavily on the dollar, this sign of accelerated foreign inflows to U.S. assets is a clear plus for the greenback, analysts said.

The November data do show a fairly substantial amount of interest from private investors. However a large component of net inflows to U.S. assets continues to come from foreign central banks. Indeed, Japan's monetary authorities have accelerated their massive purchases of U.S. assets during recent weeks via currency market interventions designed to curb yen strength.

Foreigners' net purchases of U.S. Treasury bonds and notes were $33.4 billion in the month of November, sharply up from a revised $12.04 billion of net purchases in October, according to monthly international capital flows data released by the Treasury Department.

Foreigners' net purchases of U.S. equities totaled $8.78 billion in November, a reversal from a revised $1.24 billion of net sales in October, the data showed.

Foreign accounts made net purchases in long-term U.S. agency bonds of $10.6 billion in November, up from $9.42 billion net purchases in October.

Agency bonds are securities issued by the government sponsored enterprises, such as Fannie Mae (FNM) and Freddie Mac (FRE)

Foreigners' net purchases of U.S. corporate bonds were $29.7 billion in November, up from net purchases of $20.93 billion in October. |

2025.12.16 图文交易计划:布油开放下行 关2425 人气#黄金外汇论坛

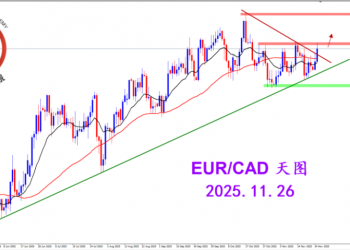

2025.12.16 图文交易计划:布油开放下行 关2425 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3156 人气#黄金外汇论坛

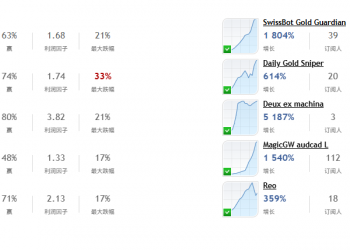

2025.11.26 图文交易计划:欧加试探拉升 关3156 人气#黄金外汇论坛 MQL5全球十大量化排行榜3197 人气#黄金外汇论坛

MQL5全球十大量化排行榜3197 人气#黄金外汇论坛 【认知】5997 人气#黄金外汇论坛

【认知】5997 人气#黄金外汇论坛