[摘]

Reuters

China c.bank says yuan role to gradually weaken

Monday March 27, 9:21 pm ET

BEIJING (Reuters) - China raised the prospect on Tuesday of allowing market forces to play a greater role in setting the value of the yuan, saying most companies had adapted well to the country's floating exchange rate regime.

The comments by central bank chief Zhou Xiaochuan came against the background of intense U.S. pressure on Beijing, ahead of President Hu Jintao's visit to Washington next month, to take firm action to cut its big trade surplus with the United States.

The yuan (CNY=CFXS) is the focus of U.S. pressure because China has let the currency rise only 1.1 percent since it was unshackled from the dollar last July and revalued an initial 2.1 percent.

"Half a year after the foreign exchange reform, we can see that most Chinese companies have weathered this reform thanks to hard efforts, though a small number of industries has been greatly affected," the Economic Daily quoted Zhou as saying.

"Based on this, we think we can let market supply and demand gradually play a bigger role in the currency float," he said.

The newspaper said Zhou was speaking at a conference organized by a cabinet think tank on March 20.

Zhou also said China's trade surplus, which tripled last year to $102 billion, was set to fall, though not immediately.

"We reckon China may need two to three years to achieve a basic balance in international trade," Zhou, the governor of the People's Bank of China, said.

As the surplus came down, China's accumulation of foreign exchange reserves would slow, he said.

China overtook Japan in February to become the country with the world's biggest stockpile of reserves, the China Business News reported on Tuesday.

It said China's reserves increased $8.5 billion in February to $853.7 billion following a $26.3 billion jump in January.

China ran a bilateral trade surplus with the United States last year of $202 billion, according to the official U.S. tally, and several law-makers in Washington are preparing legislation designed to bring two-way trade into better balance.

The initiatives include a bill by Senators Charles Schumer and Lindsey Graham that threatens to impose a 27.5 percent tariff on China's exports to the United States if Beijing does not revalue the yuan closer to what they deem to be its market value.

But Zhou said the level of the yuan was not key to achieving better-balanced trade. He also said accusations that China was manipulating its currency would not win widespread international support.

Although China was coping well with life under floating rates, Zhou said, various Chinese companies and financial institutions still needed time to adapt. |

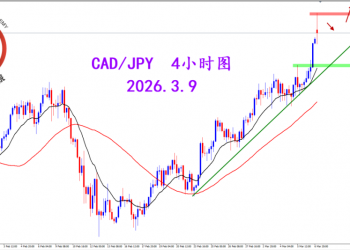

2026.3.9 图文交易计划:加日突破压制 多头232 人气#黄金外汇论坛

2026.3.9 图文交易计划:加日突破压制 多头232 人气#黄金外汇论坛 网纸「TL282.cc」腾龙公司游戏会员账号注册464 人气#美股论坛

网纸「TL282.cc」腾龙公司游戏会员账号注册464 人气#美股论坛 网纸「TL282.cc」腾龙公司注册游戏会员账号404 人气#美股论坛

网纸「TL282.cc」腾龙公司注册游戏会员账号404 人气#美股论坛 网纸「TL282.cc」腾龙怎么注册账号会员58 人气#游枷利叶 专栏

网纸「TL282.cc」腾龙怎么注册账号会员58 人气#游枷利叶 专栏