G-7 Sees Potential for Faster Growth, Statement Says (Update3)

Deauville, France, May 17 (Bloomberg) -- Finance ministers from the Group of Seven major industrial nations said they are ``confident'' economic growth can recover from a two-year slump without offering any specific policies to achieve a revival.

``Our economies continue to face many challenges,'' according to a draft statement distributed to reporters in Deauville, France where ministers from the G-7 and Russia are meeting. ``We are nonetheless confident in the potential for stronger growth.''

The draft didn't mention currencies. The euro's rise against the dollar is eroding demand for Europe's exports, making it hard for the region's economies to grow. A U.S. economy which faltered at the start of the second quarter showed signs of regaining its footing this month, reports on manufacturing and jobs show.

The G-7, which accounts for two-thirds of the world's gross domestic product, expanded 1.3 percent last year and 0.6 percent in 2001, the worst back-to-back showing since the mid-1970s. The European Central Bank came under pressure from French, Italian and German ministers before the meeting to lower interest rates.

``Europe is locked into great economic difficulties,'' International Monetary Fund Managing Director Horst Koehler said in an interview at the meeting. ``I'm sure the ECB knows the right thing to do in this situation.

Quaden Signals Cut

The ECB, whose benchmark rate of 2.5 percent is twice that of the U.S. Federal Reserve, is being urged to reduce borrowing costs because the finance ministers may not say anything today to halt the dollar's slide. Exports account for 35 percent of the euro region's gross domestic product.

``It is probable if the euro rate continues to rise that will be a factor that facilitates the decline in inflation and opens the door to a further easing of monetary policy,'' ECB council member Guy Quaden said in a recorded interview on Belgium's RTBF television network broadcast today.

The dollar dropped to $1.1592 per euro at 5:15 p.m. in New York yesterday from $1.1386 on Thursday. The euro, which has climbed 25 percent in the past year, began trading at $1.16675 in 1999. It fell to a low of 82.31 U.S. cents in October 2000.

While currencies aren't part of today's formal agenda, ministers will discuss them, said European Union Monetary Commissioner Pedro Solbes, who is also in Deauville.

``It will come up come up in the general debate,'' Solbes told reporters. ``We know there are elements of interest there.''

Currencies

The economy of the dozen countries that share the single currency is on the brink of recession, according to European Union figures released this week. Gross domestic product shrank 0.2 percent in Germany, 0.1 percent in Italy and 0.3 percent in the Netherlands.

``This weekend will be the most closely watched by market participants since the days surrounding the Plaza and Louvre Accords in the late 1980s,'' said Laurence Goodman, managing partner at Globaleqon LLC, a New York-based economic consulting firm. ``Exchange rate policy is the most closely watched item.''

In 1985, after the dollar had risen to levels that hurt U.S. exports, G-7 members threw their weight behind a weaker U.S. currency. Within months of the so-called Plaza Accord, the dollar had fallen 20 percent against the yen and West Germany's deutsche mark. Two years later, the G-7's Louvre Accord allowed the dollar to come back from its lowest level against the yen.

Risks Recede

Japan's economy, which didn't grow at all in the first quarter, is also being hurt by the dollar's slide. When the yen reached a 10-month high of 115.82 against the dollar yesterday, Vice Finance Minister Masakazu Hayashi threatened to buy dollars to prevent the yen from rising further.

The G-7 draft statement said ``major downside risks'' to growth had receded. After the end of the U.S.-led war in Iraq last month, financial markets have rebounded from their recent lows. The Dow Jones Industrial Average has gained 7 percent since the beginning of April and the cost of a barrel of crude oil has stayed below $27, almost a fifth below its pre-war level.

The G-7 comprises the U.S., Japan, Germany, France, the U.K., Italy and Canada. The Russian finance minister is also attending the talks, aimed at preparing for a summit of the leaders of the G- 7 plus Russia at the end of the month.

Last Updated: May 17, 2003 08:31 EDT

谁电脑安装了金山快译请翻译一下吧! |

2025.12.16 图文交易计划:布油开放下行 关2572 人气#黄金外汇论坛

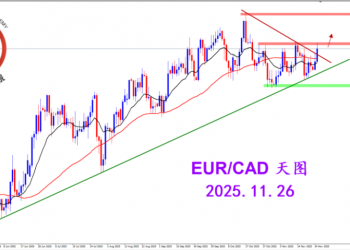

2025.12.16 图文交易计划:布油开放下行 关2572 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3170 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3170 人气#黄金外汇论坛 MQL5全球十大量化排行榜3236 人气#黄金外汇论坛

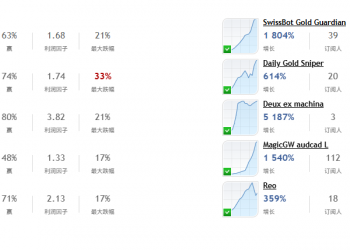

MQL5全球十大量化排行榜3236 人气#黄金外汇论坛 【认知】6029 人气#黄金外汇论坛

【认知】6029 人气#黄金外汇论坛