4月7日以来,加元一直受执政党(自由党)丑闻的困扰而下跌。

1。反对派最早在5月18日可以提出“不信任动议”,如果执政党在此动议上失败,将面临下台或举行选举。2。QUEBEC区要求独立的呼声也高涨起来。

第二季度升息的可能性较小,最早要到今年秋季。

------------------------------------------------------------------------------------------------------

Canadian Dollar Declines More Than Any Currency This Month

April 29 (Bloomberg) -- Canada's dollar had its biggest monthly decline in a year, falling more than any other currency, on concern the governing Liberal party will face a no-confidence vote following the release of testimony in a kickback scandal.

The currency fell on all but three days since April 7, when testimony was released from a Quebec inquiry alleging Liberals received payments in exchange for government contracts. The opposition will be able to introduce a no-confidence motion as early as May 18. The Liberals would be forced to resign or call an election should they lose a no-confidence vote.

``The whole political situation is the backdrop for Canada at the moment, and it has been placing pressure on the Canadian dollar,'' said Drew Devine, a currency strategist at Investors Bank & Trust in Boston. ``The uncertainty factor is huge.''

Against the U.S. dollar, the Canadian currency dropped to 79.47 cents, the lowest since Oct. 19, from 79.86 cents yesterday, at 5 p.m. in Toronto. One U.S. dollar buys C$1.2584. The currency slid 1.9 percent this week and 3.8 percent in April, more than any of the 60 currencies tracked by Bloomberg.

Prime Minister Paul Martin this week said he consented ``in principle'' to scrap C$4.6 billion in corporate tax cuts in favor of increased spending in his proposed budget, meeting the demands of New Democratic Party leader Jack Layton. In exchange, the New Democrats won't support the no-confidence motion against Martin's minority Liberals.

The opposition Conservatives, who said they are seeking to push out the Liberals over the scandal, need the backing of the separatist Bloc Quebecois party to win the no-confidence vote.

`Negative' for Dollar

Support for the Bloc is 55 percent in Quebec, compared with 16 percent for the Liberals, according to poll conducted April 24 and 27 by the Strategic Counsel, the Globe and Mail reported.

``If Quebec support for sovereignty remains high, that will be negative for the Canadian dollar,'' said Ted Carmichael, economist at JPMorgan Securities Inc. in Toronto.

Canada's 3 percent bond maturing in June 2007 fell 5 cents to C$99.83, pushing its yield up 4 basis points, or 0.04 percentage point, to 3.08 percent, or 2 basis points for the week. The 5 percent bond due in June 2014 dropped 27 cents to C$106.44, lifting its yield 3 basis points to 4.14 percent. The yield fell 2 basis points for the week.

Canadian two-year bonds have outperformed their U.S. counterparts for more than four months, pushing the yield 57 basis points below Treasury notes of similar maturity. Ten-year bonds yield 6 basis points less than 10-year Treasuries. They last yielded more than U.S. notes on Feb. 24.

`Waning Expectations'

The yield on the Canadian bankers' acceptance futures contract due Sept. 19, a gauge of interest-rate expectations, traded at 2.85 percent, down 30 basis points from a month ago. The advance suggests fewer investors forecast a rate increase by the next quarter. The central bank has kept its target rate at 2.5 percent since October.

``We've got waning expectations for Bank of Canada tightening,'' said Marc Levesque, chief strategist of fixed income and foreign exchange at TD Securities Inc. in Toronto. ``Markets are no longer looking at anything happening until the fall.''

Bankers' acceptance contracts settle at Canada's three-month lending rate, which has averaged 19 basis points above the central bank's current target since Bloomberg started tracking the gap in 1992.

The government said gross domestic product in February rose 0.3 percent, from 0.2 percent in the previous month. The growth rate matched the median forecast of 23 economists surveyed by Bloomberg News.

In the U.S., Canada's biggest trading partner, first-quarter gross domestic product grew at an annual 3.1 percent pace, the Commerce Department said yesterday in its initial estimate, from 3.8 percent in the previous quarter. The economic growth rate was the slowest in two years. |

2026.3.4 图文交易计划:黄金大幅下行 短期190 人气#黄金外汇论坛

2026.3.4 图文交易计划:黄金大幅下行 短期190 人气#黄金外汇论坛 2026.2.13 图文交易计划:美指持续震荡 等1580 人气#黄金外汇论坛

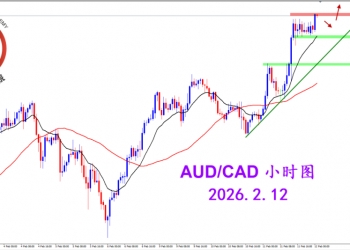

2026.2.13 图文交易计划:美指持续震荡 等1580 人气#黄金外汇论坛 2026.2.12 图文交易计划:多头持续挺进 澳1542 人气#黄金外汇论坛

2026.2.12 图文交易计划:多头持续挺进 澳1542 人气#黄金外汇论坛 2026.2.11 图文交易计划:磅加坚决阴线 适1742 人气#黄金外汇论坛

2026.2.11 图文交易计划:磅加坚决阴线 适1742 人气#黄金外汇论坛