13 Jul 2004 03:06 GMT

Hong Kong shares lower led by telcos; chipmakers down after Merrill downgrade

HONG KONG (AFX-ASIA) - Share prices were lower in early trade, after opening flat, following the mixed performance of Wall Street overnight, with telecom stocks leading the falls after Nasdaq's weakness, dealers said.

HSBC was steady after news that it will buy Marks & Spencer PLC's financial services division, M&S Money, while semiconductor stocks were hit by news that Merrill Lynch had revised its recommendation on the global chip sector to "underweight" from "overweight", they said.

At 10.34 am, the Hang Seng Index was down 119.95 points or 0.98 pct at 12,071.06, after opening up 0.71 points or 0.01 pct at 12,191.72.

Main board turnover was at 2.41 bln hkd, with 988.54 mln shares changing hands.

"The market is lacking a focus. Telecos are leading falls after the weakness on Nasdaq," said Simon Tam, senior sales manager at Kim Eng Securities.

HSBC was flat at 116 hkd after news that it is buying Marks & Spencer PLC's financial services division.

"The purchase looks promising, as the bank's retail business would be strengthened in the UK," Tam said.

"Its retail banking business in the UK is now broadened, but the debt settlement of Marks & Spencer of over 1.0 bln stg looks burdening," said a dealer with a regional brokerage.

HSBC will buy M&S Money for 762 mln stg, a premium of 224 mln stg over net asset value, and will also take on net debt of 1.24 bln stg. M&S will retain 60 mln stg of the business' net assets.

Other banks were lower in line with the market, with Hang Seng Bank down 0.25 hkd or 0.25 pct at 99.25, Bank of East Asia down 0.15 hkd or 0.67 pct at 22.4 and BOC Hong Kong down 0.05 hkd or 0.39 pct at 12.9.

Chip makers were lower after a downgrade by Merrill Lynch on the global semiconductor sector, dealers said.

SMIC was down 0.02 hkd or 1.3 pct at 1.52 and Solomon Systech was down 0.07 hkd or 3.8 pct at 1.77.

Telcos were leading the losses today after the declines on Nasdaq, dealers said.

China Mobile was down 0.4 hkd or 1.75 pct at 22.45, China Unicom down 0.25 hkd or 3.97 pct at 6.05 and Hutchison was down 0.5 hkd or 0.94 pct at 52.5.

PCCW lost its momentum after it said that it has not yet reached any agreement with China Netcom over a possible stake sale in a PCCW unit.

PCCW was down 0.1 hkd or 1.77 pct at 5.5.

"There can be no assurance that any such agreement or letter of intent will be signed," the company said in a statement to the Stock Exchange of Hong Kong.

The statement was filed in response to a media report that PCCW has entered into a framework agreement with China Netcom in relation to the sale of an equity stake in the company's wholly-owned unit PCCW-HKT Telephone Ltd.

PCCW announced in May that China Network Communications Group Corp (China Netcom), the mainland's second-largest operator of fixed-line services, is interested in taking a stake in PCCW-HKT, the core fixed line business of PCCW.

Property stocks were also lower, with Cheung Kong down 0.75 hkd or 1.28 pct at 57.75, Sun Hung Kai Properties down 0.75 hkd or 1.16 pct at 64 and Henderson Land down 0.1 hkd or 0.23 pct at 42.7.

H-shares were lower, extending losses amid continued concerns that more companies in the sector might follow Yanzhou Coal's move to raise money through share placements.

"These (share placement) concerns will continue to drag H-shares lower," UOB Kay Hian (HK) director Steven Leung said.

The Hang Seng China Enterprise Index was down 50.74 points or 1.2 pct at 4,194.78.

Among China-related stocks, Denway Motors was down 0.125 hkd or 4.27 pct at 2.8, Brilliance China down 0.125 hkd or 5.68 pct at 2.075 and Angang Newsteel down 0.1 hkd or 3.48 pct at 2.775.

Sanmenxia Tianyuan Aluminum (8253.HK), a state-controlled aluminum producer based in China's Henan province, was at 0.275, after opening at 0.28 and against its offer price of 0.3, on its debut on the Growth Enterprise Market (GEM).

Dealers said trading overall is cautious ahead of key data releases in the US this week.

The US is scheduled to release the retail sales, PPI and CPI data for June later this week.

Overnight, the Dow Jones Industrial Average (DJIA) finished up 25 points, or 0.2 pct at 10,238.22, while the Nasdaq composite closed down 9.41 points or 0.5 pct at 1,936.92 after bouncing back from a session low of 1,921.

(1 usd = 7.8 hkd)

susanna.tai@afxasia.com

st/rc |

2025.12.16 图文交易计划:布油开放下行 关2649 人气#黄金外汇论坛

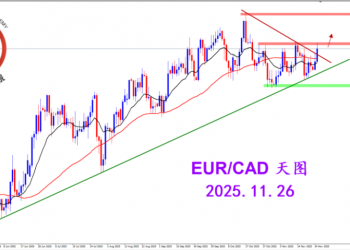

2025.12.16 图文交易计划:布油开放下行 关2649 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛

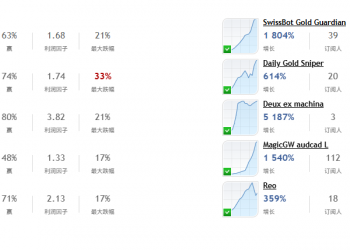

2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛 MQL5全球十大量化排行榜3262 人气#黄金外汇论坛

MQL5全球十大量化排行榜3262 人气#黄金外汇论坛 【认知】6053 人气#黄金外汇论坛

【认知】6053 人气#黄金外汇论坛