Despite intra-day volatility, the dollar and Euro have again struggled to break out of existing ranges. There has been little in the way of direction from US data and caution ahead of the US Fed decision on June 30th has stifled trading. The Euro/dollar market has also been overshadowed by yen developments.

Although limited, the US data was generally disappointing for the US currency. Jobless claims rose to 349,000 in the latest week from 336,000 the previous week, while there was a surprise 1.6% decline in durable goods orders for May. The final estimate for first-quarter GDP growth was also revised down to 3.9% from 4.4%. These negatives were offset by a slight rise in consumer confidence and by strong housing-sector figures and economic strength should still be sustained in the short term.

There is still uncertainty over the Fed's actions next week, but fragile data this week has reinforced market speculation over a 0.25% rate increase rather than a 0.5% rise. Given that the dollar has discounted a move in short-term rates to at least 2.0% this year, a slower pace of tightening would leave the currency vulnerable to downward pressure. As well as the rate decision, the Fed statement will be very closely watched to assess whether the central bank will consider a 0.5% rate increase in August. A commitment to a measured pace of tightening would be likely to undermine the US dollar, although substantial downward pressure is unlikely.

The dollar was unsettled by security concerns during the week after bomb attacks in Turkey and Iraq. There is a risk that tensions will increase further ahead of the June 30th hand-over of power to the local authorities and this will tend to be a negative factor for the US currency. The impact will be magnified if the markets become more concerned over the widening current account deficit, emphasising the potential importance of Wall Street. |

2025.12.16 图文交易计划:布油开放下行 关2647 人气#黄金外汇论坛

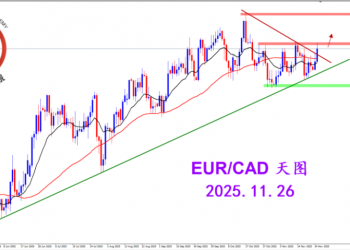

2025.12.16 图文交易计划:布油开放下行 关2647 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛 MQL5全球十大量化排行榜3261 人气#黄金外汇论坛

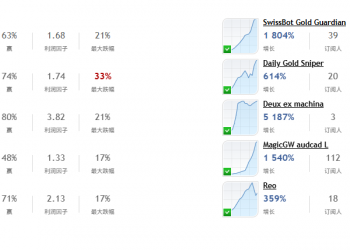

MQL5全球十大量化排行榜3261 人气#黄金外汇论坛 【认知】6053 人气#黄金外汇论坛

【认知】6053 人气#黄金外汇论坛