The lowest interest rates in a generation will soon be gone.

The Federal Reserve has given formal notice that short-term interest rates will rise. It's just a matter of when -- maybe at the end of June, maybe in early August, possibly later.

The Fed's rate-setting Open Market Committee left short-term rates alone, as expected. The newsworthy element of Tuesday's meeting was what the Fed said -- or rather, what it didn't say.

The Fed removed the word "patient" from its post-meeting statement, in which it assesses the economy and explains its reason for current rate policy. Since January, the panel had been saying that it could be patient in raising rates. (And for four months before that, it said low rates could remain "for a considerable period.") This time, the word "patient" was missing -- an indication that the economy is heating up. The newly worded statement prepares investors and borrowers for an eventual rate increase.

"At this juncture, with inflation low and resource use slack, the Committee believes that policy accommodation can be removed at a pace that is likely to be measured," the panel wrote. The phrase "policy accommodation" means low rates. In this year's previous statements, the Fed had said it could be "patient in removing its policy accommodation."

There isn't much difference between being patient and moving at a measured pace, but the new phrase is a signal that the Fed is moving toward raising rates gradually. Sending a message that it is keeping an eye on prices, the rate-setting body said, "incoming inflation data have moved somewhat higher, long-term inflation expectations appear to have remained well contained."

Fed officials, including Chairman Alan Greenspan, had been dropping hints for weeks that the rate-setting panel was becoming more optimistic about the economy, especially in light of strong job creation in March. With these hints came an implicit promise that the Fed wouldn't spring any surprises. The next Fed meetings are June 29-30 and Aug. 10. Observers believe a rate increase will most likely come in the August meeting. The rate increase could happen in June if the job market zooms like a rocket in the next month, or in September or later if the job surge loses momentum.

"I think the story is the wording of the statement," says Bob Walters, vice president of secondary marketing for Quicken Loans. Greenspan has "taken pains to make the Fed more transparent to the markets" so as not to surprise them, he says.

For now, the target federal funds rate will remain 1 percent and the prime rate will remain 4 percent. Rates will stay more or less unchanged on loans tied to the prime rate -- many, but not all, auto loans, credit cards, home equity loans and equity lines of credit.

Rates on 15- and 30-year fixed-rate mortgages respond to the market's expectations about the overall economy. In the last month, long-term mortgage rates have gone up about half a percentage point while the federal funds and prime rates stayed steady.

The federal funds rate, also known as the overnight rate, is what banks charge one another for overnight loans to cover reserves. The Fed indirectly controls the overnight rate by selling and buying securities to add and withdraw cash from the banking system.

Until the first week of April, economists and investors had been predicting that the Fed wouldn't raise rates until the committee's November meeting at the earliest. Then on the first Friday in April came the employment report for March, which said that the economy produced a net 308,000 jobs that month. The report was much stronger than expected. After 30 months of trying to crank the cold economy back to life, it appeared that policymakers in the Fed, Congress and White House finally had gotten the economy started.

The federal funds rate has been under 2 percent since December 2001 as the Fed's way of encouraging businesses and consumers to borrow money and provide oomph to the economy. Congress and the White House have cut income taxes, putting more money in consumers' pockets, and at the same time have gone on a spending spree like a gaggle of teenagers set loose in a shopping mall with their parents' credit cards.

It took much longer than expected for the resulting economic stimulus to bring job creation and inflation, but those signs of revival finally showed themselves in the first three months of this year. Now the Fed is getting ready to raise rates to cool off the economy and keep inflation under control. |

2025.12.16 图文交易计划:布油开放下行 关2649 人气#黄金外汇论坛

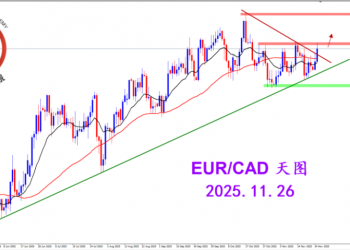

2025.12.16 图文交易计划:布油开放下行 关2649 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛

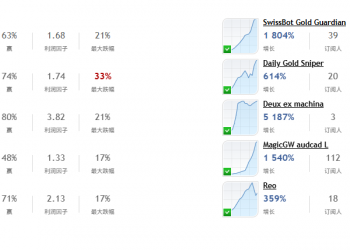

2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛 MQL5全球十大量化排行榜3261 人气#黄金外汇论坛

MQL5全球十大量化排行榜3261 人气#黄金外汇论坛 【认知】6053 人气#黄金外汇论坛

【认知】6053 人气#黄金外汇论坛