GLOBAL MARKETS-Investors focus on U.S. jobs, oil price slips

Fri Jun 4, 2004 05:17 AM ET

By Jeremy Gaunt, European Investment Correspondent

LONDON, June 4 (Reuters) - Investors focused on Friday on a pending U.S. employment report for hints on the direction of interest rates, keeping many financial markets ticking over.

European equities were moderately higher, demand for bonds slipped slightly and the dollar traded in a narrow range ahead of the jobs report from Washington.

Oil, which has dominated markets over the past few weeks, fell and was well below its recent highs.

U.S. non-farm payrolls for May were due at 1230 GMT. A Reuters poll forecast 216,000 jobs added to payrolls, building on strong numbers in the previous two successive monthly reports.

But some players were betting on a higher number and ING Financial Markets said its in-house Labour Market Indicator was pointing to a number in excess of 400,000.

The report is seen as a crucial indicator of the U.S. economy's strength at a time when the U.S. Federal Reserve is expected to raise interest rates, ending the era of ultra-easy monetary policy.

"The market will make a quick reaction to the data," said Richard Adcock, technical analysts at UBS Warburg in London. He said market volatility would iHncrease "at about 1230 GMT and one second".

Oil, meanwhile, was causing little stir. U.S. light crude (CLc1: Quote, Profile, Research) was at $38.94 a barrel, down 34 cents and off the $42.45 seen earlier in the week. Brent crude (LGOc1: Quote, Profile, Research) was at $36.15, down 25 cents.

STOCKS, BONDS, DOLLAR

European shares were moderately higher with investors eyeing the jobs report.

The FTSE Eurotop 300 index of pan-European blue chips was up 0.37 percent and the narrower DJ Euro Stoxx 50 index (STOXX50E: Quote, Profile, Research) was 0.58 percent higher.

Earlier, Japanese stocks ended higher as bargain-hunters picked up recently battered exporters.

The Nikkei average added 0.92 percent to close at 11,128.05, bouncing back from a 1.91 percent drop on Thursday. The broader TOPIX index rose 0.48 percent to 1,124.97.

The dollar sat in tight ranges versus other major currencies.

The dollar traded at $1.2207 per euro (EUR=: Quote, Profile, Research) , slightly down on the day. It was at 111.96 yen (JPY=: Quote, Profile, Research) , steady on the day.

"You don't want to put on too much risk now," said a trader at a foreign brokerage in Tokyo. Euro zone government bond yields pushed higher as investors dug into positions ahead of the U.S. report.

The two-year Schatz yield (EU2YT=RR: Quote, Profile, Research) was up 1.3 basis points at 2.607 percent. On Thursday, the yield touched a three-week high of 2.647 percent intraday.

The 10-year Bund yield (EU10YT=RR: Quote, Profile, Research) was barely changed at 4.381 percent, well off a six-month high of 4.415 percent struck early in the session on Thursday. |

2025.12.16 图文交易计划:布油开放下行 关2649 人气#黄金外汇论坛

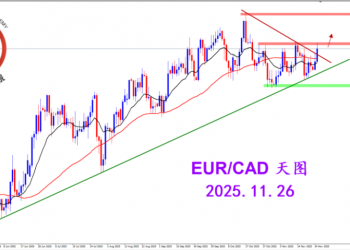

2025.12.16 图文交易计划:布油开放下行 关2649 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛

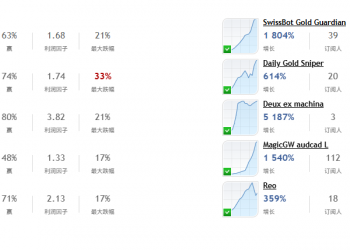

2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛 MQL5全球十大量化排行榜3262 人气#黄金外汇论坛

MQL5全球十大量化排行榜3262 人气#黄金外汇论坛 【认知】6053 人气#黄金外汇论坛

【认知】6053 人气#黄金外汇论坛