Market was worried about US economy would hurt by the high oil prices; dollar was weak against all major currencies. As US consumer confident was not as good as expected, when the data released, dollar continually weaker broadly. All major currencies was break thought original resistance level to get the new high on Tuesday’s trading.

EURO/USD: As Germany IFO data out roughly as expected, euro has not got any pressure by the market. With weak dollar trade last night, euro was keeping strength. And also, ECB officer announced that they would not readjust central rate in the hurry, so euro was not feel any pressure. Technical views: Euro was keeping in the upward trend in the short time. The Euro resistance level is 1.2150, and then 1.2180; Support level is 1.2080, and then 1.2020.

Trading range: 1.2160-1.2050

USD/JPY: As weak dollar trading on yesterday, Yen was getting some market support. Technical view: As dollar yen major resistance level is about 113.30 and then 114.00. Support is above 110.80.

Trading range: 113.50-110.80

GBP/USD: As the potential interest rate hike in UK and weak consumer confident in US; sterling was gain almost 1% against dollar as several weeks high. And also, the British economy was also gains some advantage by those days high oil prices, because UK is oil outputs country. All those support sterling to gain more against greenback. Technical view: The resistance level is near about 1.8260. The next support level is 1.8000, and then 1.7890.

Trading range: 1.8260-1.8000

AUD/USD; NZD/USD: Both Aussie and Kiwi, was getting some profit on weak dollar yesterday. And also, they were climbing to the new high on last night. Technical view: Aussie: In the short term, Aussie was in the upward trend. The support level would be 0.7030, and then 0.6980 and the resistance level would be 0.7130and then 0.7160; Kiwi dollar: The next support of Kiwi is 0.6140, and then 0.6080, Resistance level would be 0.6200.

Trading range: AUD/USD: 0.7160-0.6980; NZD/USD: 0.6240-0.6130 |

2025.12.16 图文交易计划:布油开放下行 关2650 人气#黄金外汇论坛

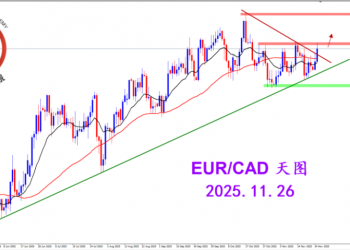

2025.12.16 图文交易计划:布油开放下行 关2650 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛

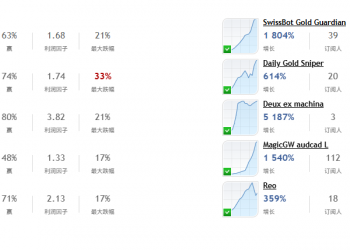

2025.11.26 图文交易计划:欧加试探拉升 关3187 人气#黄金外汇论坛 MQL5全球十大量化排行榜3262 人气#黄金外汇论坛

MQL5全球十大量化排行榜3262 人气#黄金外汇论坛 【认知】6054 人气#黄金外汇论坛

【认知】6054 人气#黄金外汇论坛