Bombings in Turkey and Iraq in the weekend brought geopolitical risks into investors’ concern. And the ever rising oil price also boosted all major currencies strength against dollar. Right before US close, profit-taking was given back some lost ground to dollar. Market was still seeking some more economic data and news as a signals of future trading.

EURO/USD: Yesterday, as still no major data out in market from Europe. Sunday’s Turkish bombs and new records high of oil prices boosted up the euro against dollar almost 1%. The market profit-taking pull the price down right before US closed. Technical views: Euro shows “dabble-bottom” by chart reading. So Euro might be had some retracement. Euro resistance level is 1.2090, and then 1.2160; Support level is 1.1970, and then 1.1880.

Trading range: 1.2090-1.1970

USD/JPY: By market concern about geopolitical and new records high of oil prices, dollar yen was under the sell-off pressure. And then, the market profit-taking pull dollar-yen back up to 114.Dollar Yen was still trade in range market, yesterday. Technical view: As dollar yen efficiently up break 114 as perverse high, major support is above 114.00, and then 113.40. Resistance is about 114.50, and then 115.50. (As FIBO 38.2% retracement)

Trading range: 115.00-113.40

GBP/USD: There was no major data out in UK. As market was expected Monetary Policy Committee members announced their discussion which would provide clues on how much the rate need to move. There were many support of sterling at low. And also the Turkey’s bomb explosions just before British Prime Minister Tony Blair’s visit; and new high of oil prices pushed up the Cable up to gain nearly 1% against dollar. Technical view: The resistance level is near about 1.7780 and then 1.7820. The next support level is 1.7490.

Trading range: 1.7780-1.7570

AUD/USD; NZD/USD: By market re-concern about geopolitical, followed lead of Euro and Sterling, both Aussie and Kiwi was fighting back against dollar. As high yield currencies, there were no clear supports for Aussie and Kiwi. Technical view: Aussie: Aussie was still staying in the down side trend. The resistance level would be 0.6980 and the support level would be 0.6820, and then 0.6730; Kiwi dollar: Kiwi was also in the down side trend. The next support of Kiwi is 0.5910, and then 0.5860, Resistance level would be 0.6050, and then 0.6150.

Trading range: AUD/USD: 0.6980-0.6800; NZD/USD: 0.6100-0.5920

以上评论完成于18:30 GMT; Beijing 2:30AM |

2025.12.16 图文交易计划:布油开放下行 关2651 人气#黄金外汇论坛

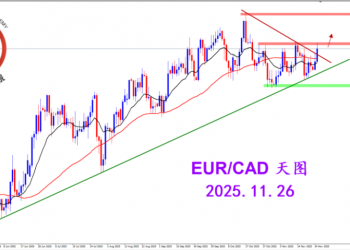

2025.12.16 图文交易计划:布油开放下行 关2651 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛

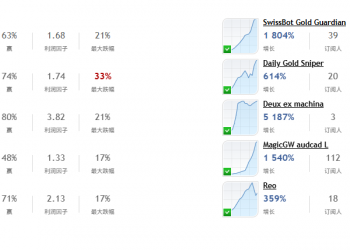

2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛 MQL5全球十大量化排行榜3262 人气#黄金外汇论坛

MQL5全球十大量化排行榜3262 人气#黄金外汇论坛 【认知】6054 人气#黄金外汇论坛

【认知】6054 人气#黄金外汇论坛