美国数据继续温和, 非美货币小幅回调

隔夜主要经济数据: 1. 美国3月份商业存货为0.7%;预期为0.5% 2. 美国4月份消费者信心指数为(CPI)为0.2%;预期为0.3% 3. 美国4月份工业生产为0.8%;预期为0.5% 4. 美国5月份密西根大学消费信心指数为94.2;预期为96

隔夜市场分析: 昨天, 亚洲,欧洲方面并没有主要数据出台, 美国的经济数据成为市场的交易坐标.由于先前的市场预期, 该数据将支持美国的升息预期, 美元早盘走强,非美货币继续遭到抛压; 然而后期数据公布后, 则与预期差强人意, 非美货币伺机反弹. 但周五市场的获利平仓操作,又将非美拉回其主要的交易区间. 后市并没有明确今后的交易方向,各货币保持稳定.

今日操作建议: 虽然中期美元依然看强,但短期时市场期待明确的交易方向.区间交易为主, 建议短线操作, 或观望.

欧元:昨天, 欧洲方面仍然没有主要数据出台, 美元继续领导市场的走势. 由于美国不十分理想的消费者信心指数和密西根大学消费信心指数,导致欧元兑美元完成当日回调上涨近0.6%. 而周五的获利平仓又将欧元拉回到1.1900下方. 技术方面: 欧元兑美元仍然保持在1.1980-1.1760的区间内. 阻力为1.1940,然后是1.1980; 支持位为1.1760, 然后是1.1730. 预期波动区间: 1.1940-1.1730

日元: 昨天的美元兑日元基本摆脱了日本股市对汇市的影响. 美元兑日元也基本跟随市场波动,后市受到抛压,整体仍维持区间交易. 技术分析:美元日元在有效突破114.00阻力后, 美元兑日元支持位在114.00,然后是113.40而上方阻力在114.50,然后是115.50.( 自2001年11月的高点到今年3月的38.2%的回调) 预期波动区间: 115.00-113.40

英镑: 由于英国方面昨天没有主要数据出台, 美元成为市场的焦点. 由于预期数字不错, 在昨天美国消费信心指数(CPI)公布之前, 美元提前上扬, 导致英镑兑美元跌至1.7490的菲波拉其50%重要支持位. 然而在CPI公布后以及美国略差于预期的密西根大学消费者信心指数公布后, 英镑大举反攻. 一度上扬至1.7650的市场阻力价位. 后市受周五市场获利平仓的举措而小幅度回调.技术分析: 由于近期英镑仍然维持在下降通道内,预计短期仍受抛压. 上升阻力为1.7680,然后是1.7780; 而主力支持位是1.7490. 预期波动区间: 1.7680-1.7490

澳元和纽币: 在美国数据公布后, 欧元和英镑的上扬, 带领澳,纽币在昨天继续走出回调行情.尽管作为高收益货币, 澳币纽币在本周遭到重创, 但周五的反弹仍然给市场带来亮点. 恢复了部分人气. 技术分析: 澳币继续保持在下降通道内, 仍然有市场抛压. 支持位在0.6820然后是0.6730, 阻力则为0.6980;纽元: 也处于下降通到中. 支持位位于0.5980, 然后是0.5920.阻力则在0.6050,然后是0.6150. 预期波动区间: 澳元0.6980-0.6800;纽元 0.6100-0.5980

以上评论完成于AKL6:30AM (GMT+12); Beijing 2:30AM |

2025.12.16 图文交易计划:布油开放下行 关2651 人气#黄金外汇论坛

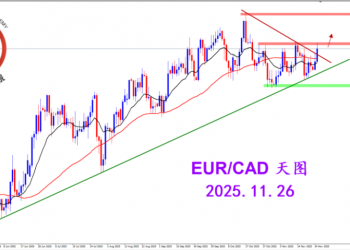

2025.12.16 图文交易计划:布油开放下行 关2651 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛

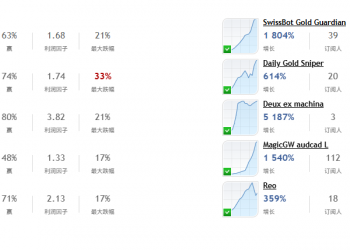

2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛 MQL5全球十大量化排行榜3262 人气#黄金外汇论坛

MQL5全球十大量化排行榜3262 人气#黄金外汇论坛 【认知】6054 人气#黄金外汇论坛

【认知】6054 人气#黄金外汇论坛