隔夜主要经济数据: 1. 英国央行宣布提高利率25个基点; 2. 欧洲央行宣布维持利率2%不变; 3. 美国第一季度非农业生产力指数为3.5%;预期为3.5%; 4. 美国本周初次申请救济金人数为315K; 预计为335K;

隔夜市场分析:昨天欧洲方面利息数据成为市场关注的焦点. 尽管欧洲央行的利息维持不变; 英国加息0.25个基点, 都符合先前的预期. 但美国本周初次申请救济金人数和第一季度非农业生产力指数都显示美国基本面消息依然强劲. 并加强了对周五4月份非农业就业数据向好的普遍预期. 从而引发美元今天走出的大举反攻的升势.

今日操作建议: 市场静待本周五, 美国的非农业就业人数的数据. 该数据将引导市场对美国近期加息的预期, 除非该数据特别好, 美元将大幅度走强. 否则, 非美货币有回调风险.

欧元: 昨日,欧洲央行公布维持利率不变, 符合市场预期. 但随着美国强劲的本周初次认领救济金人数公布后, 市场普遍认为周五的非农业就业人数仍然向好.美元的反攻,导致了欧元有获利回吐的卖盘. 技术方面:欧元在跌破1.2080的支持位后, 市场止损, 继续抛售欧元.后期伴有逢低的买盘. 阻力为1.2180 ; 支持位为1.2030, 然后是1.1970. 预期波动区间: 1.2140-1.1980

日元:随着日本假期的结束, 日本市场步入正轨. 昨天, 日本财务省表示,日本央行在4月份的交易中并没有抛售日元.但同时表示, 干预政策并没有改变.昨日随美元的大幅度反攻, 日元美元也大幅度反弹. 技术分析: 在美元日元上破109.30并站稳后, 其支持位在109.30, 然后是108.30而上方阻力在109.75, 然后是110.50. 预期波动区间: 110.50-109.30

英镑:英镑在英国央行调高利率25个基点后小幅上升,和市场预期一致. 英镑在加息后微幅走强. 在美国强劲的本周初次认领救济金人数公布后, 英镑有获利回吐的卖盘. 技术分析: 英镑基本维持在原来的区间波动. 预计短期上升阻力为1.8020; 而主力支持位1.7850, 然后是1.7770. 预期波动区间: 1.8020-1.7850

澳元和纽币: 由于美元昨晚的反弹行情,投资者的观望态度, 使得澳,纽币并没有获得有效的市场支撑. 澳,纽币在跟随欧元英镑在昨天全面走软.技术分析: 澳元主力支持在0.7170附近,然后是0.7080.阻力则为0.7320. 纽元: 支持位位于0.6230.阻力则在0.6370. 预期波动区间: 澳元0.7280_0.7150;纽元 0.6370_0.6230

以上评论完成于AKL6:30AM (GMT+12); Beijing 2:30AM |

2025.12.16 图文交易计划:布油开放下行 关2653 人气#黄金外汇论坛

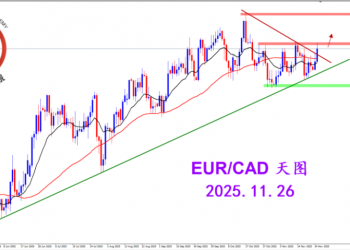

2025.12.16 图文交易计划:布油开放下行 关2653 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛

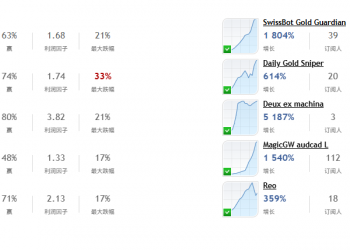

2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛 MQL5全球十大量化排行榜3263 人气#黄金外汇论坛

MQL5全球十大量化排行榜3263 人气#黄金外汇论坛 【认知】6056 人气#黄金外汇论坛

【认知】6056 人气#黄金外汇论坛