隔夜市场分析: 昨天早些时候, 格老的乐观的证词令市场大起波澜. 讲话强化了美国即将升息的预期, 美元得到提振, 非美货币在讲话后应声下跌.在昨晚第2轮的讲话中, 格老偏于中立的发言, 使得市场又小起波浪. 当格老提及具体加息时间未定后,非美一度反攻. 随后回落.

今日操作建议: 警惕非美货币回调风险, 建议寻高卖出.

欧元: 国际货币基金会(IMF)今天表示, 欧元区经济复苏力度不够, 消费回落, 失业增多, ECB应做好降息准备. 技术方面分看, 欧元仍处在下跌通到中, 阻力位位于1.1920然后是1.1980, 在有效突破1.1850后, 欧元支持位为1.1760.

预期波动区间: 1.2090-1.1850

日元: 昨日, 国际货币基金委员会曾表示, 日本经济将温和复苏, 但日元快速升值和结构性疲软仍是很大的负面风险. 昨天由于美元兑日元的交易, 虽有振荡, 但仍维持在上升区间波动. 支持位在108.30.而上方阻力在110.40附近.

预期波动区间: 110.40-108.30

英镑: 由于英国央行公布货币政策委员会(MPC) 9位会员中只有1位同意本月升息.而先前预期为6比3. 原因在于, 委员们担心增值的英镑将会抵消房屋市场上涨带来的通涨影响.消息过后, 英镑跌幅增至0.8%. 在技术分析上看, 英镑在有效突破1.7750后, 仍然有处于下跌通道的区间交易.下一个支持则在1.7580然后是1.7360(去年8月抵点到今年2月高位的50%回调). 阻力位于1.77590. 警惕回调风险, 建议寻高卖出.

预期交易区间: 1.8150-1.7790

澳元和纽币: 在昨天, 由于澳,纽没有新的经济数据. 格老讲话加强了美国的升息预期,作为商品货币, 将会打击澳元和纽币对投资者的吸引力. 跟随英镑和欧元的带领, 澳元和纽币今日都走出跌势. 中期仍有卖盘危险. 澳元若跌破0.7280的颈线后, 回迎来新的一轮下跌走势. 主力支持在0.7170附近.纽元若有效跌破0.6180(去年9月低点到今年2月高位的61.8%回调)的后则会继续下, 支持位位于0.6050附近.

预期交易区间: 澳元0.73700.7170;纽元 0.62800.6100

[ Last edited by 张大硕 on 2004-4-22 at 02:27 PM ] |

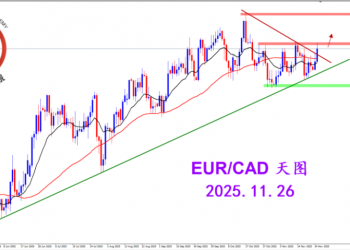

2025.12.16 图文交易计划:布油开放下行 关2652 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关2652 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛

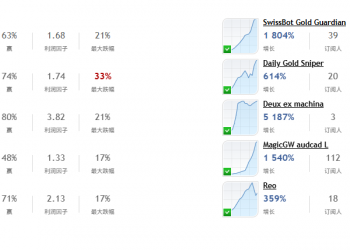

2025.11.26 图文交易计划:欧加试探拉升 关3188 人气#黄金外汇论坛 MQL5全球十大量化排行榜3263 人气#黄金外汇论坛

MQL5全球十大量化排行榜3263 人气#黄金外汇论坛 【认知】6055 人气#黄金外汇论坛

【认知】6055 人气#黄金外汇论坛