[路透社快讯]

============================================================

Welcome [Sign In] To track stocks & more, Register

Financial News

Enter symbol(s) BasicPerformanceReal-time MktDetailedChartResearchOptionsOrder Book Symbol Lookup

Reuters

FOREX-Dollar stung, then recovers after U.S. trade data

Wednesday March 10, 9:08 am ET

By John Parry

(Updates prices, adds comment; changes byline, changes dateline, previous LONDON)

NEW YORK, March 10 (Reuters) - The dollar slipped briefly against the euro after a U.S. trade report showed a wider than expected trade gap but swiftly recovered to remain higher on the day on Wednesday.

The wide U.S. trade deficit continues to be one of the biggest weights on the dollar but analysts said the euro's bounce higher in the immediate wake of the U.S. data swiftly evaporated. Traders were still wary of buying the single European currency after its fall below a key technical area the prior session.

The U.S. January trade deficit was $43.06 billion, compared with an upwardly revised December deficit of $42.69 billion. Economists' median forecasts had been for a January trade deficit of $42.05 billion.

"The euro's rise in reaction to the report looked a bit lukewarm to me. There seems to be a lack of conviction that this paves the way for sizable euro gains against the dollar, because I suspect there is just too much nervousness for those who are still positioned long euro," said Sean Callow, currency strategist with IDEAglobal in New York.

Long positions in a currency are essentially bets that it will appreciate.

However, Callow added, "I don't think (the report) changes the big picture. Those who are bearish on the dollar over the course of the year will have their expectations reinforced. They will see this in line with that bearish view, that the dollar still has further to fall to help correct the (U.S. trade) deficit."

Early morning in New York, the euro (EUR=) was down 0.6 percent on the day around $1.2240, from $1.2305 shortly before the trade report's release.

The euro has shed about six cents since hitting record highs against the dollar above $1.2900 in mid-February.

Against the yen (JPY=) the dollar was down about 0.2 percent on the day to 111.08 yen.

Against the Swiss franc (CHF=), the dollar was up about 0.3 percent on the day to 1.2857 francs.

Sterling (GBP=) was down 0.7 percent to $1.8125.

Earlier in the session, the dollar had held a firm bias against European currencies while holding steady on the yen.

Investors remained on alert for yen-selling intervention by Japanese monetary authorities although upward pressure on the yen was alleviated by an unexpected downward revision in Japan's growth data for October-December.

"People are still unwinding their positions and moves are not happening based on fundamentals. The market is still thinking the Fed will be on hold for longer and wants to sell the dollar, but it is still adjusting to the recent major shakeout in positions," said Mary Davis, global foreign exchange strategist at Credit Suisse First Boston.

Japan said the economy grew a real 1.6 percent in October-December from the previous quarter, revising down its initial reading of 1.7 percent released in mid-February. However, it was still the best performance in 13 years.

The Bank of Japan was suspected of intervening on Tuesday after the dollar tumbled toward 110 yen. Money market analysts in Tokyo estimated Japan probably intervened to the tune of 500 billion yen ($4.50 billion) on Tuesday. There was no confirmation from the authorities.

Japan has intervened aggressively to curb the yen's export-crimping rise. Its dollar buying has amounted to more than 30 trillion yen since last year.

Bank of Japan governor Toshihiko Fukui said earlier on Wednesday Japan's intervention policy was consistent with the bank's own efforts to drag the economy out of deflation. He added irregular currency moves were damaging to the economy.

=========================================================== |

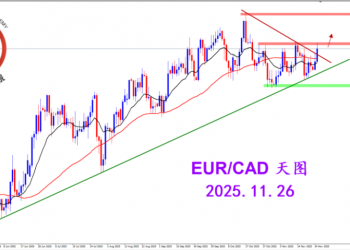

2025.12.16 图文交易计划:布油开放下行 关2425 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关2425 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3154 人气#黄金外汇论坛

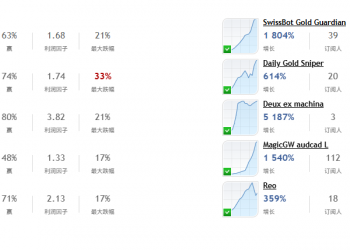

2025.11.26 图文交易计划:欧加试探拉升 关3154 人气#黄金外汇论坛 MQL5全球十大量化排行榜3196 人气#黄金外汇论坛

MQL5全球十大量化排行榜3196 人气#黄金外汇论坛 【认知】5996 人气#黄金外汇论坛

【认知】5996 人气#黄金外汇论坛