推荐者:沙皮 “这是REFCO和FXCM 统一的研究资料. 我相信对美元的基本面分析具有相当的深度. ”

本人花了两个多小时,完成了一大半翻译,结果论坛的程序以来路不正确和太长,使得前功尽费。 只好先把英文贴出,共部分汇友先睹为快。 本人将在周末时安排时间翻译了。 欢迎能者帮忙,不胜感谢。

The US Dollar Outlook for 2004Q1 - Trends and Risks

Published: 12/30/03

- Recap of 2003 Dollar Decline

- Risks for the Dollar in 2004

- Individual Pair Analysis

- What Could Prompt a Reversal in the Dollar Decline?

- What Could Turn a Downtrend Into a Collapse?

- Trends for the US Economy in 2004

In recent months, the decline in the US dollar has been hitting the headlines of all major financial publications. Since the beginning of this year, the trade weighted dollar index has fallen over 14%, while declining 20% against the euro. Based upon both technical and fundamental analysis, the collapse in the dollar is expected to continue. However, the dollar's weakness against currencies such as the EURUSD, are at very extreme levels, suggesting that a need for a meaningful correction cannot be overstated. This implies that volatility will be the theme in the first quarter of 2004.

What we have seen in 2004 is that a rebounding economy does not necessarily translate into a strengthening dollar. A widening current account deficit that is funded primarily by foreign central banks will continue to exert downward pressure on the US dollar. Before elaborating on the outlook for the US dollar, we will first recap the forces that pushed the dollar lower throughout 2003.

Recap of 2003 Dollar Decline

Weak Economy

Although the economy began to show signs of recovery in the second half, it was insufficient in reversing the dollar's decline. According to the National Bureau of Economic Research (NBER), a nonprofit private organization that determines the official dates for business cycles, the latest recession in the US began in March 2001 and ended in November 2001. Unfortunately, the average American will tell you otherwise. Since November 2001, growth has been disappointing while corporations have continued to shed jobs. After a brief rise in the US equity markets in the first quarter of 2002, stocks collapsed throughout the remainder of the year and into the first quarter of 2003. The war in Iraq further increased geopolitical tensions and uncertainty in the US economic recovery. GDP in the first quarter was a mere 1.4%, as businesses refrained from investing before a significant pickup in consumer demand. The Federal Reserve responded by slashing interest rates to a 45-year low of 1%. Also, for the first time in history, the Federal Reserve noted the risk of deflation in their monetary policy statement. With no room to maneuver interest rates and the US' commitment to ensure that the country does not fall into the same type of deflationary spiral as Japan, the market realized that one of the few tactics the Federal Reserve can rely on to combat deflation is a weakening of the US dollar.

Twin Deficits

Another problem for the US is that it currently has large and growing "twin deficits." The US current account deficit has just retraced from a record high of 5.2% of GDP to 4.9%, while the budget deficit is predicted to reach 4.7% of GDP in 2004. The presence of a current account deficit in the US is no surprise considering that the country has been running current account deficits for the past 10 years. However, this year in particular, it has become a primary concern because the US current account deficit is at record levels with no signs of a reversal, while interest rates are at multi-decade lows. The US currently needs more than $1.5 billion in daily foreign inflows to prevent the USD from depreciating any further based upon trade. The federal budget deficit also reached an all time high in 2003 due to the Iraq war, recession and the weak economy. If you recall, it was only 2 years ago that the US was running a budget surplus.

De facto 'Weak Dollar Policy'

Time and again we have heard both President George W. Bush and Treasury Secretary John Snow repeat the Bush administration's commitment to a strong dollar. However, the markets believe that a strong dollar may not be the administration's true agenda because their actions imply otherwise. Recent tax and interest rate cuts have been in line with expansionary fiscal and monetary policies - the repercussions of both of these initiatives have been a weaker dollar. More specifically, interest rate cuts lower the attractiveness of US assets such as treasuries, causing a decreased demand for the US dollar. What the market believes to be a covert weak dollar policy is further supported by the talk of the US encouraging or pressuring China to float their currency. In the September G7 meeting, the US, in its most overt abandonment of a strong dollar, led a call for other nations to apply "more flexible exchange rates." If China heeded to these demands, the Chinese Renminbi would strengthen, forcing a further weakening of the US dollar.

Dollar Expected To Trend Lower In First Quarter of 2004

Dollar weakness is expected to persist in the first quarter of 2004. It is important for traders to understand that acceleration in US economic growth does not necessarily translate into a recovery for the US dollar. As mentioned earlier, the primary cause for the dollar's decline in 2003 was the widening US current account deficit - a problem that has yet to be resolved. The current account deficit is expected to widen even further as the economy recovers. The rationale is that during rebounds, consumers will be increasing demand for both domestic and foreign goods. Coupled with the Bush administration's continued de facto weak dollar policy, the dollar will remain under pressure.

However, there are a number of forces that could potentially reverse or accelerate the dollar's decline in 2004. A reversal of the dollar's downtrend could occur if a strong US economic recovery prompts a stock market rally and a boom in M&A activity, drawing foreign investors back to US assets- the weak dollar makes US corporations particularly attractive takeover targets. Intervention by the Federal Reserve or ECB to halt the decline in the dollar or curb the rise in the Euro could also help to reverse the market's current bearish sentiment. On the other hand, the risks for a sharp acceleration in the dollar's decline could be prompted by stronger than expected Eurozone growth, more flexibility in the RMB or new US scandals. 2004 is also an election year and any surprises on that front could also have significant ramifications for the dollar.

Where Do We See The Majors (EURUSD, USDJPY, USDCHF, GBPUSD) in the First Quarter of 2004?

EURUSD: Technicals favor a correction before the next move higher

The medium-term bull move initiated this summer continues to push higher at a torrid pace. Our initial first quarter targets of 1.1935 and 1.25 are now only memories, as the price closes in on 1.2600 psychological resistance. The pace and scale of the upmove, while impressive, is now bordering on excessive as both sentiment and longer -term momentum oscillator studies reach frightening extremes. The need for a meaningful correction can not be overstated and as such, we now expect the first half of 2004 to be a bit rockier than most, as longer-term technical studies point to some sort of corrective wave during the first few months of 2004. Initial corrective targets include the former breakout level/10-day SMA at 1.1935/1.1900 followed by the former fib resistance turned support in the 1.1750 zone. We cannot rule out a deeper correction scenario to the 40-week moving average in the coming months, as corrections from such aggressive runups, can turn quite vicious; but as overall long-term demand remains firm we see no real serious threat to broader long-term uptrend.

USDJPY expected to slide to 105 (technicals call for a move to 100)

The comments following the G7 meeting this past September is a good reflection of the direction that the Bush administration wants to guide the USD against Asian currencies such as the Yen and Renminbi. Back in September, Treasury Secretary Snow said that they would like to see "more flexibility in exchange rates…for major countries." In 2003, the BoJ spent a record Y20trillion in an attempt to prevent the JPY from appreciating against the USD. However, judging from this year's intervention activities and the market's reaction, their efforts have been primarily geared towards slowing the eventual decline in USDJPY.

For 2004, the BoJ/MoF has already announced its plans to increase their "intervention war chest." The current supplementary budget is approximately Y79trillion. Subject to parliamentary approval, the finance ministry plans on raising the ceiling by Y82bln - Y21trln for this fiscal year (ending March) and Y61trln for the next fiscal year. This means that from now until the end of the next fiscal year, the Bank of Japan will have over Y160trln to spend on interventions. This suggests that the Ministry of Finance and the Bank of Japan have no intentions of curbing their intervention activities in 2004.

However, despite intervention, the strength of Japanese growth in 2003 has certainly taken the market by surprise. After 10 years of stagnation, the Japanese economy has finally turned around. Improving Japanese fundamentals and a rising stock market is drawing foreign investors and fund managers, who have traditionally been underexposed to Japanese equities to adjust their portfolios. We expect this trend to continue as businesses predict increased spending in 2004. As a result, USDJPY is expected to grind lower towards 105. However, the persistence of Japanese intervention will make for a bumpy ride down to 105.

The long/medium term technical outlook for USDJPY has turned decidedly bearish after September's collapse below the 115.00 widely watched weekly/monthly head and shoulders neckline. The measured objective of the pattern, or the length of the distance from the head to the neckline, is roughly 2000 pips, which puts the downside projection at the 95.00 level. Overly aggressive objectives, however have a tendency of disappointing (as the yen did in 1999) and, as such, we see the psychologically significant 100.00 level as a more realistic downside target. The move lower could prove to be grind though as the 61.8% Fibonacci retracement of the 1995-1998 bull wave at 105.50 should at a minimum inspire some weak hand short covering. Should the pair rally off the support zone we see scope for a move back up to 110.00 or even the 113.50 G-7 weekend gap but no higher than the 115.00 neckline/base.

USDCHF: Weak hand shorts need to be shaken out

During the early summer we had seen good potential for a reversal as the pair had just broken above the 23.6% fib retracement of the 2001-2003 bear wave and the 1.41 neckline of a weekly reverse head & shoulders. The technical break proved false and nothing more than a bull trap as the pair quickly traded back below the neckline and into the bear channel. The resumption of the weekly channel and break of the 1.2780-1.2650 long-term confluence (of the October 1998 lows, the 2003 lows and the 78.6% Fibonacci retracement of the 1995-2000 bull move) points to a bit more downside as there is no real support until the monthly 1.24/1.23 congestion zone. In this area we expect the start of some sort of corrective wave that shakes out weak hand shorts. but nothing that threatens the underlying long-term down trend. Initial contra-move targets/downtrend resumption areas include the 1.2780 former breakdown level, 10-day SMA and the 40-week SMA, though a break above the latter could see a deeper than expected retracement to even the 55-week SMA. We cannot rule out risk of an all-out dollar collapse on a break of the 1.23 support zone (although we feel it is highly unlikely). In such a scary scenario, we could see the buck trade down to the 1.11 100% retracement level of the '95 - '00 bull wave before bottoming out.

GBPUSD: A bit more upside before a corrective wave lower

Clearly improving UK fundamentals, a strong housing market, optimistic business sentiment, rising employment and robust consumer spending has prompted the Bank of England to shift to a hiking bias. The recent upward revisions in economic releases support our belief that the UK's trend of superior economic performance will continue into the first quarter of 2004. Furthermore, as one of the first central banks to hike rates, the widening spread between UK gilts and US treasuries will continue to benefit the GBP in the months ahead.

The Cable uptrend remains in full force despite two serious attempts to break it during 2003. The first came in early January with a downside assault on the 55-week SMA. The second saw a test of the 38.2% Fibonacci retracement of the two-year upmove. Both times support held, correctly confirming the strength of the trend and the bulls' resolve. The runup since the September lows has been exceptionally fierce with the pair easily taking out both the 1.7366 October 1998 high and the 1.75 psychological resistance barrier. The lack of real resistance until 1.7800/1.800 opens the way for another leg higher before the parabolic nature of the upmove catches up with the Sterling. As in other European currencies, we expect some sort of correction in the first few months of 1H04 as monthly and weekly oscillators desperately need to unwind from overbought levels. Key downside supports include the 10-week SMA and the 1.7083 former breakout level. As in EUR/USD, the selloff will be considered only corrective in nature and nothing that really challenges the broader long-term uptrend.

What Could Reverse The Decline in the Dollar?

Revival of stock market rally

A strong revival in the US equity markets could fuel renewed interest in US assets. Despite impressive returns this year of 29% and 52% for the Dow and Nasdaq respectively, the weak dollar has deterred foreign investment. Returns in the FTSE (25%), DAX (44%) and Nikkei (28%) have been equally impressive. A continued US economic recovery could accelerate the gains in the both the Dow and Nasdaq, which sooner or later will become too attractive for foreign investors to ignore. Once foreign investors realize that they are grossly underweight US equities, a sharp acceleration in accumulation and readjustment of portfolios could prompt a strong surge in the US dollar.

Pickup in cross-border M&A activity

Continued cross border M&A flows could also fuel a reversal in dollar. The current weakness of the dollar makes US corporations particularly attractive takeover targets. The slump in the dollar in the latter half of 1998, prompted some of the all-time biggest M&A deals. The more high profile deals between 1998 and 2000 include Fleet's acquisition of Bank Boston in 1999, Credit Suisse Group's acquisition of DLJ in 2000, British Petroleum's acquisition of Amoco in 1998 and Daimler's acquisition of Chrysler in 1998. Between 1998 to 2000, the dollar index rallied approximately 20%, as the surge in M&A activity drew strong foreign investment. During the same period, the Dow Jones Industrial Average rallied over 45%. A continued decline in the US dollar will only increase the attractiveness of US corporations. A renewed surge in cross-border M&A activity would not only drive demand for dollars from the actual acquirer, but also from investors who want to piggyback on the potential gains.

FX Intervention by Fed or ECB

Intervention by the Federal Reserve or the ECB to halt the decline in the dollar or curb the rise in the Euro could prompt a sharp acceleration in the dollar. In fact, intervention by either of these central banks would relay a strong message to the market and has the potential to significantly reverse the dollar's decline. Although the market discounts the effectiveness of intervention by the Bank of Japan and uses BoJ intervention as an opportunity to sell at better levels, intervention by the Federal Reserve and the European Central Bank (ECB) is different because both central banks rarely choose intervention as an option. The last time the Fed and the ECB intervened was in November of 2000 when they bought euros and sold dollars below the 0.90 level. Complaints are beginning to filter in from Eurozone officials, beginning with Dutch CB Wellink, ECB Quaden, Bundesbank Recker and EU Prodi. Although the head honchos such as Trichet, Issing and Welteke have been very vocal about their comfort with the Euro's current move, a continuation of the acceleration in the Euro will eventually force them to shift gears as well. A recent article by Market News gives a hint of where the ECB's comfort level is as it reports that conversations with ECB sources revealed that, "they did not expect the ECB would consider intervening unless the euro-dollar rate rose to around $1.35, near the all-time highs of the "synthetic" euro prior to 1999." Regardless, if and when the Fed or ECB chooses to intervene, the dollar would be expected to have a sharp reaction.

What Could Turn a Downtrend Into a Collapse?

More flexibility in Chinese Yuan

Although the Chinese government remains committed to their decade-old tight trading band, many economists are calling for an end to Yuan peg in 2004. A complete revaluation of the Yuan may be a bit too optimistic, but a widening of the trading band could be likely. China's top economic planner has already warned that a sharp revaluation of the Yuan could cause global instability and thwart China's growth. However, inflationary pressures are growing with inflation accelerating 3% in November, which is its fastest pace in six years. Pressure from foreign governments such as the US have also yet to dissipate, which means that increased efforts by the manufacturing industry and its advocates to pressure the US government to force a revaluation, may prompt China to find a mean to appease its trade partners. Increased flexibility in the Chinese Yuan however, would certainly mean an upward revaluation of the Yuan. A decision by the Chinese government to widen their trading band could prompt an accelerated decline in the US dollar, particularly against the Japanese Yen.

Mutual scandals

Corporate scandals have been plaguing the US equity markets since 2001. If the abundance of mutual fund scandals increase and receive enough press, not only would it deter foreign investment, but could force current foreign investors to retract their funds. The possibility of mutual fund scandals is not completely improbable. In fact, six stock funds have already been named in trading probes, prompting a $21.3billion collective outflow. Scandals can stem from extra incentives offered to brokers to sell their funds, undisclosed fees in annuities or other products and manipulating/ignoring their own trading rules. As the government increases their crackdown on the financial industry, an upsurge in mutual fund scandals can have significant negative ramifications for the dollar.

Acceleration in Eurozone growth

A surprising acceleration in Eurozone growth above and beyond current expectations could prompt a renewed rally in the Euro. Eurozone growth is currently excepted to accelerate from 0.5% in 2003 to 2.5% in 2004, while US growth is expected to accelerate from approximately 3.0% to 4.4%. An expansive monetary policy and the global economic recovery should help to spur Eurozone growth. Unfortunately, this is the least likely scenario given that the strength in Euro has been and will continue to hurt foreign demand. |

2025.12.16 图文交易计划:布油开放下行 关2239 人气#黄金外汇论坛

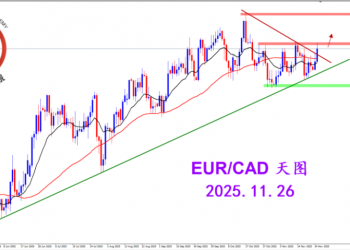

2025.12.16 图文交易计划:布油开放下行 关2239 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3095 人气#黄金外汇论坛

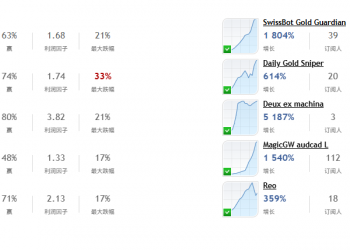

2025.11.26 图文交易计划:欧加试探拉升 关3095 人气#黄金外汇论坛 MQL5全球十大量化排行榜3134 人气#黄金外汇论坛

MQL5全球十大量化排行榜3134 人气#黄金外汇论坛 【认知】5923 人气#黄金外汇论坛

【认知】5923 人气#黄金外汇论坛