NEW YORK -- A short-term bounce in the US dollar was boosted by stronger US data last week, including better than expected Q3 corporate results, combined with more intervention from Asian central banks.

"It’s not clear how quickly the market will react and there is a lot of adjusting to do," said Robert Sinche, global head of FX research at Citibank in New York. "But this is a meaningful rally." It is likely to continue until the end of this year, he added.

"The US dollar may have bottomed for now against both Asian and European currencies," agreed Mansoor Mohi-Uddin, FX strategist at UBS in London.

The driver of dollar weakness has not been demand, but production and employment, said analysts. Last week regional manufacturing surveys were upbeat, and unemployment claims continued to trend lower. "The US is entering a more sustained expansion process," said Sinche. "And the interest rate markets are starting to adjust their expectations -- a key factor in the dollar recovery."

But the dollar remains vulnerable, said analysts. "The US trade deficit continues to remain high, and the market still suspects the US government wants the dollar to keep weakening ahead of next year’s presidential elections," said Mohi-Uddin. |

2025.12.16 图文交易计划:布油开放下行 关2688 人气#黄金外汇论坛

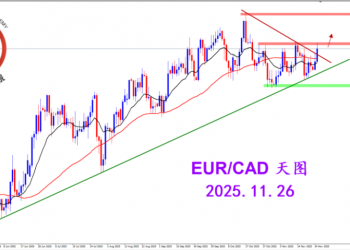

2025.12.16 图文交易计划:布油开放下行 关2688 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3218 人气#黄金外汇论坛

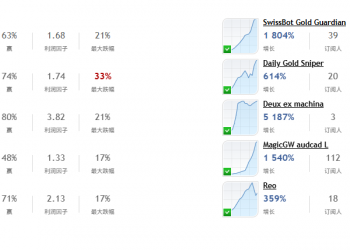

2025.11.26 图文交易计划:欧加试探拉升 关3218 人气#黄金外汇论坛 MQL5全球十大量化排行榜3298 人气#黄金外汇论坛

MQL5全球十大量化排行榜3298 人气#黄金外汇论坛 【认知】6104 人气#黄金外汇论坛

【认知】6104 人气#黄金外汇论坛