The second Bear phase is marked by a sudden mood change, from optimism and hope to shock and fear. One day, the public wakes up and sees, much to its surprise, that "the emperor has no clothes." Actual fundamental business conditions are not panning out to be as positive as previously hoped. In fact, there may be a little problem. The smart money is long gone, and there is no one left to buy when the public wants out. Stock prices drop steeply in a vacuum. Fear quickly replaces greed. Repeated waves of panic may sweep the market. Transactional volume swells as the unsophisticated investor screams, "Get me out at any price!" Sharp professional traders are willing to bid way down in price for stocks when prices drop too fast. The best that can be expected, however, is a dead-cat bounce that recovers only a fraction of the steep loss.

The third Bear phase is marked by discouraged selling and, finally, total disgust to ward stocks. Fundamentals clearly have deteriorated and the outlook is bleak. Downward price movement continues but the negative rate of change eventually begins to slow as potential sellers liquidate holdings at distress prices. Even the best stocks, which initially resist the downtrend, succumb to the persistence of the Bear. Transactional volume, which was high in the panic phase, starts to diminish on price declines as liquidation runs its course. Eventually, after everyone who is capable of selling has sold already, the Bear Market is exhausted. The discouraged public lament is, "never again." After stocks are totall sold out, the stage is then set fo the cycle to begin again. When everyone who ever is going to sell has already sold, there is only one direction for prices to go ---- up.

These phases are no secret. They have been written about by Dow and its successors for more than a century. These phases repeat endlessly, over and over again. Still, teh public never learns. It is all too easy, it is merely human nature, to get caught up in the mass mood of the moment, lose all perspective and run with the emotions of the crowd. If you do not learn how to recognize the technical indications, and if you are not disciplined, the easiest thing in the world to do is to allow your self to be pulled along by the mass mood, the "group think." But that is the way to be wrong at the critical turning points, t obuy at tops and sell at bottoms, and to consistently underperform the market. To make money and out perform the market, we need to do the opposite. The Dow Theory tells us how.

End |

2025.12.16 图文交易计划:布油开放下行 关1135 人气#黄金外汇论坛

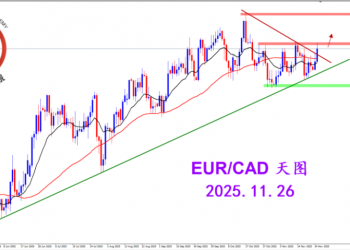

2025.12.16 图文交易计划:布油开放下行 关1135 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关2861 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关2861 人气#黄金外汇论坛 MQL5全球十大量化排行榜2934 人气#黄金外汇论坛

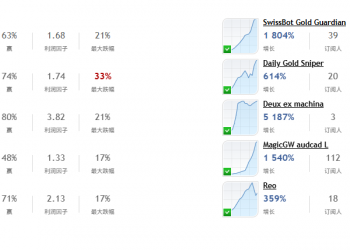

MQL5全球十大量化排行榜2934 人气#黄金外汇论坛 【认知】5725 人气#黄金外汇论坛

【认知】5725 人气#黄金外汇论坛