Sterling slips after BoE cuts interest rates

By Jennifer Hughes in London

Published: July 10 2003 11:34 | Last Updated: July 10 2003 13:12

Sterling slipped against a range of currencies after the Bank of England cut interest rates on Thursday.

The euro rose to £0.6981, up more than half a penny, after the decision was announced. The single currency was helped by the ECB's decision, announced less than an hour later, to keep its own interest rates steady. Read more about the ECB's decision

Against the dollar, sterling slipped to a month-low at $1.624. Read more about the rate cut

Economists had been divided on the likelihood of a move following mixed data over recent weeks which have shown weak manufacturing activity, but ongoing consumer spending.

But comments last week by Mervyn King, the new governor of the bank, led strategists to believe a cut was possible. Mr King, who has a reputation as a hawk, said that sterling’s gains over the past month were probably the most important development the bank would have to consider.

Thursday's meeting was all the more unpredictable given that it was Mr King's first meeting in charge of the nine-strong committee and the first meeting for Rachel Lomax, the new deputy governor for monetary policy. It was also only the second meeting for Richard Lambert, the former editor of the Financial Times.

Economists said the bank was likely to leave rates on hold at its August meeting, but did not dismiss the chance for a further rate cut at some point.

"A further easing cannot, however, be ruled out particularly if the optimism surrounding a pickup in activity in the US proves misplaced," said Simon Rubinsohn, chief economist at Gerrard.

Lex: Japan

Brokers have called the end of Japan's post-bubble blues so many times during the last decade that cynics barely listen. Now, with the Nikkei 225 surging above 10,000, the refrain is re-emerging.

Click here

The rate cut also helped the yen extend its gains against sterling as well as a range of other currencies, including against the euro, the Canadian dollar and the Australian dollar.

The yen's strength also kept the dollar under pressure as a combination of foreign inflows, and repatriation by Japanese institutions buoyed demand for the Japanese currency.

The euro fell to a fresh two-month low at Y133.1 while the Australian dollar, the Canadian dollar and sterling fell to six-week lows at Y76.43, Y85.22 and Y191.81 respectively.

Strategists said the upwards pressure on the yen was at least partly the result of repatriation of foreign assets by Japanese institutions to cover losses in the local bond market.

Japanese government bond prices recently fell sharply, in tandem with bonds elsewhere, and Japanese investors appear to be taking profits on their overseas bond holdings. Because Japanese interest rates, and bond yields, are so low, investors have been keen on foreign bonds where the yields are higher, notably Australia, Canada, the UK and the eurozone.

While most bond investments are hedged, the strength in those four currencies has meant much of the investment was un-hedged, meaning any repatriation will have a larger impact on the spot exchange rate.

Currency watch

Currency investors are once again looking to stock markets for clues to direction, with the dollar beginning to march higher in time with Wall Street. Will this last?

Click here

The dollar was at Y117.66, very close to the levels at which traders believe the Bank of Japan is likely to intervene to stem yen appreciation.

"The movements in the crosses may be an indication of the need for renewed aggressive intervention by the Japanese authorities to limit yen gains against the dollar," warned Derek Halpenny, currency economist at Bank of Tokyo-Mitsubishi.

The Bank of Japan has spent Y6,222bn curbing yen strength against the dollar this year though a series of covert interventions.

But renewed interest in Japanese equities has prompted fresh inflows of foreign capital into the yen.

Data released by the Japanese finance ministry showed net purchases by foreigners of Japanese equities totalled Y1,254.4bn last month - the second highest on record.

Tokyo stocks suffered a slight set back overnight, but still stand nearly 30 per cent higher since bottoming in April. In New York, the Dow Jones Industrial Average has gained just over 20 per cent since March. |

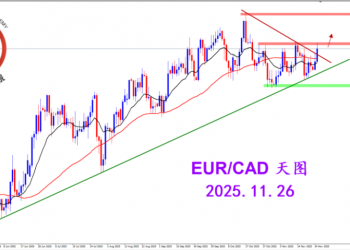

2025.12.16 图文交易计划:布油开放下行 关2660 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关2660 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3190 人气#黄金外汇论坛

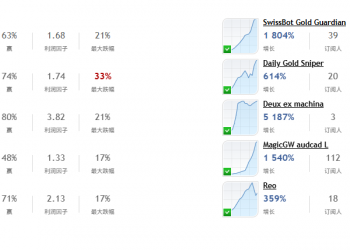

2025.11.26 图文交易计划:欧加试探拉升 关3190 人气#黄金外汇论坛 MQL5全球十大量化排行榜3266 人气#黄金外汇论坛

MQL5全球十大量化排行榜3266 人气#黄金外汇论坛 【认知】6059 人气#黄金外汇论坛

【认知】6059 人气#黄金外汇论坛