FX Snapshots: (July 10, 2003, Asian Trading 1045 EST, 0445 CET ) -

- EUR/USD found resistance at 1.1370 and is making a small sideways consolidation . . . expect further upmove to 1.1400 - 1.1410 later in the day. This is the relief rally we were looking for, and may not last long -- the currency will probably fall again from those higher levels and should make it to the 1.1100 - 1.1000 support area. GBP/USD short-term downtrend found support at 1.6280, but has rallied back to 1.6390 since then. We still think that the unit could generate a rally back to 1.6420 - 1.6430. Nonetheless, this uptick may eventually turn out to be another selling opportunity, looking for a decline towards 1.6250 - 1.61200 further out.

- USD/JPY fell further towards 117.67 and is set for further declines down the road -- we still see further decline to 117.40 perhaps even to as low as 117.00 - 116.80 later in the week. But this is probably as far as the currency will fall -- prospects of firmer greenbacks have greatly improved due to the resumption of the U.S. equity market rally. It will be no surprise if USD/JPY will commence a new upmove from 117.40/00 area, targeted at 121.50 - 122.00. USD/CHF pulled back towards the 1.3550 support area as expected, and may find firmer support at 1.3525/20 area. However, the next upmove will probably focus on at least 1.3900, perhaps even at the major resistance at 1.4100.

- USD/CAD rally extended further and has been to 1.3786. There might be a small retracement back to 1.3730 - 1.3720 area, but allow for further upmove to 1.3850 - 1.3875. Expect a correction back to 1.3700 therefater, but by and large, a rally to 1.4000 - 1.4100 is now in the making. AUD/USD downmove has gone even lower, as the currency falls to .6491. The currency may have made a significant trough at those low levels seen today. Expect a rally to make a move back towards .6600 - .6620 later in the day. But there may be one more sell-off left in the series -- allow for further decline to .6420 - 6400 after the next uptick. Further out, the longer-term outlook still applies: the main uptrend should resume thereafter and may target the .7200 - .7400 in the next major upcycle. NZD/USD fell to as low as .5760, which is much lower than our .5860 base. There should be a recovery to .5850/60, but allow for one more sell-off to the support area at .5720/10. A new upmove should develop thereafter which targets initially the .6020 top, then a new bull phase to .5300 - even .6500.

- EUR/JPY posted a new low at 133.25, and has been trading in a narrow range, with a slight bias towards 1,3420/30 area. Allow for further declines to 132.00- 131.50 thereafter. The corrective phase should end there soon. EUR/CHF cross has been to as low as 1.5375 and corrects back up somewhat. But the cross remains weak, and and the sell-off should accelerate further. The majors are facing the prospects of further declines, and EUR may take the brunt. This have negative repercussions for the cross and may cause further declines to as low as 1.5250.

Look up the individual currencies for more details and specific trading recommendations. Refer also to the Daily Equity Strategy web page for latest FX and equity updates during the New York trading session.

Stock Markets: (July 10, 2003, Asian Trading 1045 EST, 0445 CET )

- Nasdaq's outperformed the blue-chip and broad market indices again yesterday due to resilience of the disk drive, networking, computer, biotech, and semiconductor sectors. The U.S. equity market had a down-then-up day, as investors digested earnings report from Alcoa, which spent the session on the defensive. Buy rating was reiterated on Intel, but the plus factor was taken away by Altria's decline on news that the court may reverse a previous favorable ruling for the company.

- The blue-chip's underperformance was caused by setbacks in the drug, retail, defense, paper, utility, and transportation sectors. Consistent leaders to the upside were the gold and oil & gas services sectors. Closin levels: Dow -66.88 at 9156.21, Nasdaq +1.06 at 1747.52, S&P -5.62 at 1002.22.

- The equity indices pushed through the 1005 resistance again sending the index to a high of 1010 before breaking lower, and retesting the 1000 support. Technically, yesterday's performance was very disappointing -- we were expecting a much firmer stand. We therefore make allowances for further declines to 985 - 980 area if 997 is taken out early in the session. The uptrend should resume thereafter. As postulated yesterday, the very small base created (in time terms) after the 963 trough, suggests that further consolidation is needed before the uptrend resumes. Our general technical view remains the same however: a new upcycle will resume thereafter, aiming at SPX 1050 ideal levels. And further out, the rally which started in March may end by month's end, and should be followed by at least a typical 50 percent correction of the uptrend, which will generally have 915 - 900 as target.

European bourses were lower. Nonetheless, the DAX should have no trouble reaching 3400 eventually, but may also find resistance at those higher levels -- exactly for the same technical reasons and may fall to at least 3200 thereafter. CAC 40 may therefore find resistance at just under 3250 and may yet pull back to at least the 3100 area for a bigger consolidation period. The FTSE 100 may also rise back towards 4150 but may fall further towards 3950 at least thereafter. The rally resumes thereafter and may see DAX rise up to 3650, CAC 40 to 3400, and FTSE 100 to 4350 in the next 3 to 4 weeks.

FX News Background: ( July 10, 2003, Asian Trading 1045 EST, 0445 CET )

- The Australian dollar fell below 65 U.S. cents and bonds gained after a government report showed the economy unexpectedly shed 27,900 full-time jobs in June. The local dollar dropped to 64.93 U.S. cents after the release of the report by the Australian Bureau of Statistics at 11:30 a.m. in Sydney. The currency, which traded at 65.18 U.S. cents immediately before the report's release, bought 64.96 cents at 11:42 a.m.

- The Canadian dollar fell in Toronto trading, posting its biggest three-day drop since February 1985, on speculation the Bank of Canada may cut its benchmark rate as economic growth stalls, analysts said. Canada's dollar fell to 72.75 U.S. cents at 5:00 p.m., from 73.30 cents yesterday. Earlier it dropped to 72.58 cents, a 2.7 percent decline from Friday's close and the biggest three-day percentage tumble in 18 years. A U.S. dollar buys C$1.3747. The currency may weaken to C$1.3925 in coming weeks, said Andrew Delano, a currency analyst at IDEAglobal in New York.

- Japanese stock benchmarks rose for a fourth day, paced by drugmakers, after a U.S. Food and Drug Administration advisory panel recommended the agency approve Shionogi & Co.'s Crestor, its cholesterol-reducing drug. The Nikkei 225 Stock Average added 0.3 percent to 10,023.91 as of the 11 a.m. lunch break in Tokyo. The Topix index climbed 0.5 percent to 984.63, with drugmakers contributing 22 percent of the index's gain. Elsewhere in Asia, Singapore's Straits Times Index rose for an eighth session, its longest in winning streak in more than 3 1/2 years.

- The European Central Bank will leave interest rates unchanged until September, after policy makers indicated they've done enough to help a recovery in the 12 economies sharing the euro, a survey of economists showed. The ECB will keep the benchmark refinancing rate at 2 percent at its next two policy meetings in Frankfurt on Thursday and July 31, all 23 economists surveyed by Bloomberg News said. Policy makers will pare rates by a quarter point at their Sept. 4 meeting, according to the median forecast of the economists.

- ECB President Wim Duisenberg, who will retire later this year, last week said interest rates have already fallen enough to kick-start growth. The $8 trillion euro economy stagnated in the first six months and there are ``significant risks'' to a return to growth in the second half, the European Union said Wednesday.

- The Dow Jones Industrial Average fell as Altria Group Inc. slumped on concern that a court may reinstate a $12 billion deposit required for the company to appeal a ruling. Intel Corp. led an advance in computer-related shares that lifted the Nasdaq Composite Index. The Dow dropped 66.88, or 0.7 percent, to 9156.21, with Altria accounting for almost a third of the drop. The S&P 500 slipped 5.63, or 0.6 percent, to 1002.21. The Nasdaq rose for a third day, gaining 1.00 to 1747.46, closing at the highest in almost 15 months for a second straight session.

Euro/US Dollar - July 10

EUR/USD - (1.1358) 0258 EST; 0858 CET - EUR/USD found resistance at 1.1370 and is making a small sideways consolidation . . . expect further upmove to 1.1400 - 1.1420 later in the day. This is the relief rally we were looking for, and may not last long -- the currency will probably fall again from those higher levels and should make it to the 1.1100 - 1.1000 support area.

Cover short position (1.1326) at current level (1.1358) for a small loss. Sell again at 1.1415. Initial stoploss: 1.1530. Trading objective: 1.1050.

British Pound/US Dollar - July 10

GBP/USD - (1.6322) 0316 EST; 0916 CET - GBP/USD short-term downtrend found support at 1.6280, but has rallied back to 1.6390 since then. We still think that the unit could generate a rally back to 1.6420 - 1.6430. Nonetheless, this uptick may eventually turn out to be another selling opportunity, looking for a decline towards 1.6250 - 1.6200 further out.

Hold short position (1.6486). Move stoploss from 1.6470 to 1.6430. Trading objective: 1.6200.

Euro/Japanese Yen - July 10

EUR/JPY - (133.54) 0327 EST; 0927 CET - EUR/JPY posted a new low at 133.25, and has been trading in a narrow range, with a slight bias towards 1,3420/30 area. Allow for further declines to 132.00- 131.50 thereafter. The corrective phase should end there soon.

Hold short position (133.52). Move stoploss from 135.20 to 134.65. Trading objective: 131.50. |

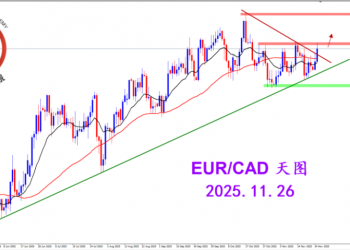

2025.12.16 图文交易计划:布油开放下行 关2660 人气#黄金外汇论坛

2025.12.16 图文交易计划:布油开放下行 关2660 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3190 人气#黄金外汇论坛

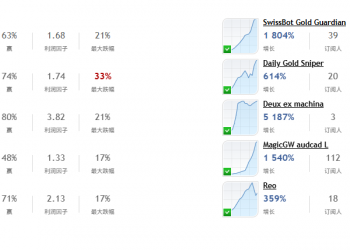

2025.11.26 图文交易计划:欧加试探拉升 关3190 人气#黄金外汇论坛 MQL5全球十大量化排行榜3265 人气#黄金外汇论坛

MQL5全球十大量化排行榜3265 人气#黄金外汇论坛 【认知】6059 人气#黄金外汇论坛

【认知】6059 人气#黄金外汇论坛