针对经济疲软,货币政策进一步放开 (1)目前经济真的开始进入衰退了吗?(2)那衰退的程度和持续的时间又是多少呢?(3)通货膨胀会成为问题吗? 我们认为问题(2)的答案才是这三个问题中最最关键的,但同时也是最不能确定的。但是,从目前看来,市场对问题(1)和问题(3)好像更为关心。在我们看来,经济衰退确实已经开始了。以过去的标准来看,我们预期这次衰退应该不会太剧烈,因为一系列的货币和财政政策已经有效的缓解了目前面临的困难,而且库存情况也比前几次经济萧条时要好很多。如果失业率正如我们所预计的那样,在今年晚些时候升到6%左右,那么一定程度的经济衰退也不会放缓通货膨胀下降的步伐。更为迫切的是,我们相信接下来几周乃至几个月的经济数据,包括即将公布的二月份就业及ISM报告,会反映出更明显的衰退迹象。目前我们预计基金利率会在年中减低到2%,其中包括三月18日在联邦公开市场委员会(FOMC)会议中可能下调的50个基点(相对于之前预测的下调25点至2.25%)。如果正如我们所料,经济在下半年呈现复苏态势的话,我们认为之后政策方面将不会再有太大的调整。目前关键的不确定因素仍然是房屋销售和价格的不断下滑以及银行持续收紧的贷款标准到底会发展到什么程度。 接下来的一周里...我们预计会有更多的经济数据释放出衰退的信号,其中包括新增加的5万名失业人口以及失业率下滑0.2%至5.1%。我们认为制造业的ISM指数会从50.7下降到46.0。同时非制造业仍然停留在50以下的水平(预测为:由44.6升至46)。同时按揭贷款拖欠率会持续上升的趋势。此外在下周会有多个美联储高层官员发表公开讲话,其中也包括美联储主席。 More weakness, more easing (1) Is the economy falling into recession? (2) If so, how long and deep? (3) Is inflation a problem? We believe (2) is the most uncertain and, ultimately, most critical of those three issues, although, for now, the focus in markets appears to be more on (1) and (3). In our view, yes, a recession is under way. We expect it will be mild by past standards, helped by monetary and fiscal easing and a much smaller drag from inventories than in past recessions. If even a mild recession is under way, with the unemployment rate up to around 6% by later this year (as we expect), then it is likely just a matter of time before inflation slows. More immediately, we expect growth data increasingly to suggest recession in coming weeks and months, including in the upcoming employment and ISM reports for February. We now forecast a reduction in the funds rate to 2.0% by midyear, including 50 bps at the next FOMC meeting on March 18 (instead of 2.25% and -25 bps, respectively). We continue to show policy on hold after that, reflecting our expectation that the economy will start to recover in the second half of the year. Key uncertainties continue to be the extent to which home sales and prices keep declining and banks continue tightening lending standards. The week ahead We expect more recession-like data, including a 50,000 decline in payrolls and a 0.2 point rise in the unemployment rate (to 5.1%). We expect the manufacturing ISM index fell to 46.0 from 50.7. The nonmanufacturing index likely stayed below 50 (forecast: 46.0 after 44.6). The mortgage delinquency rate likely continued to trend up. Numerous Fed presidents and governors are scheduled to speak, including the chairman.

这是瑞银对美国经济的看法,我一同学在瑞银证券,希望对大家有用!

如果40不喜欢,可以删除.坚决的! |

2025.12.16 图文交易计划:布油开放下行 关2657 人气#黄金外汇论坛

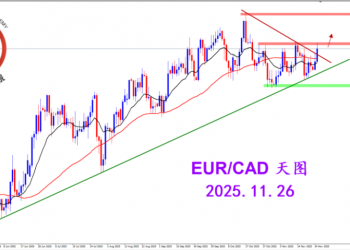

2025.12.16 图文交易计划:布油开放下行 关2657 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3189 人气#黄金外汇论坛

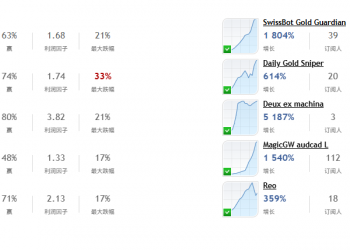

2025.11.26 图文交易计划:欧加试探拉升 关3189 人气#黄金外汇论坛 MQL5全球十大量化排行榜3264 人气#黄金外汇论坛

MQL5全球十大量化排行榜3264 人气#黄金外汇论坛 【认知】6057 人气#黄金外汇论坛

【认知】6057 人气#黄金外汇论坛