4 - 10 - 07 Sharkeater 欧元 (含英镑,及欧元/英镑,黄金)跟踪指导三周 |

回复 #72 519 的帖子

| |

|

make money and make fun

|

|

| |

|

kwokd

|

|

| |

行情变化后,对欧元,英镑后市发展的重新评估

| |

|

make money and make fun

|

|

| |

|

make money and make fun

|

|

| |

2025.12.16 图文交易计划:布油开放下行 关2220 人气#黄金外汇论坛

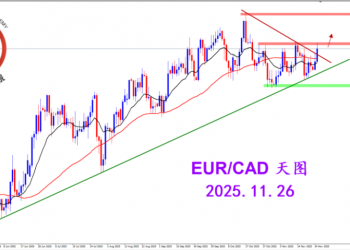

2025.12.16 图文交易计划:布油开放下行 关2220 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3094 人气#黄金外汇论坛

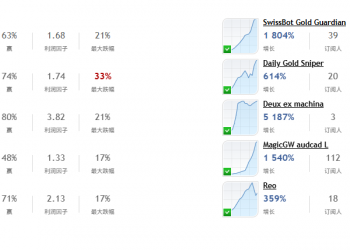

2025.11.26 图文交易计划:欧加试探拉升 关3094 人气#黄金外汇论坛 MQL5全球十大量化排行榜3133 人气#黄金外汇论坛

MQL5全球十大量化排行榜3133 人气#黄金外汇论坛 【认知】5921 人气#黄金外汇论坛

【认知】5921 人气#黄金外汇论坛