一、基本概念

TBL指标 ThreeLineBreak ,中文名为新三价线指标,属于图表型指标,其原

理是若三根K线持续上涨(或下跌)创短期新高(或新低),则发出红色(或黑色)的

柱状买入(或卖出)信号。与平时常用指标不同的是,该指标在平时盘整时并不

轻易出现信号,是一类在大盘出现明显单边趋势时提议追涨杀跌的指标。它能

有效地去除行情中无关紧要的盘整和波段上升中的震荡回调干扰,更适合于做

较大波段、做大趋势的中长期投资中比较重势的那种投资者。

二、应用法则

1、新三价线由黑色变为红色时,视为买入信号。

2、新三价线由红色变为黑色时,视为卖出信号。

注意:新三价线如果持续上涨,则会由原新三价线向上延伸,下跌亦然。因

此,新三价线不会与K线在时间横轴上相对称。

三、实例说明

如次新股(600379)宝光股份的新三价线指标。其上市第三天股价小创新低

,指标在9.87元处有一支小绿柱,投资者暂不买入,而第五个交易日股价在三天

内见新高10.28元,三价线即翻红,中线投资者可介入,此后该股震荡上行,虽走

势反复较多,但始终没有出现三天内见新低的K线组合。故新三价线或红柱延长

、或再出现红柱,提示投资者可一直持股至最高点。3月29日该股大幅回跌至

14.33元,出现头部信号,指标提示投资者卖出。此后,该股反弹不断,但新三价

线始终保持绿盘,提示下降通道,直至该股回跌到10.42元低点,一直提示投资者

不要买入。6月6日该股重新出现中阳,新三价线终于再次于11.02元处提示买入

。总体看,该股上市半年多,股价上下变化复杂,现在股价较上市时也没有明显

上升,按别的操作方法可能不会有明显的收益。但按新三价线做波段者买2次卖

1次,就有50%的获利,可谓操作简单但收益不低。

由于新三价线是一个重势不重价、提示追涨杀跌做波段的指标,不可避免

地具有明显的滞后性,对一段行情势必是弃两头、取中间。投资者不宜在行情

中途加入,一定要在长时间绿柱后翻红再介入比较安全。对于爱好短线抢反弹

、或习惯低吸高抛做法的投资者,该指标应慎用。 |

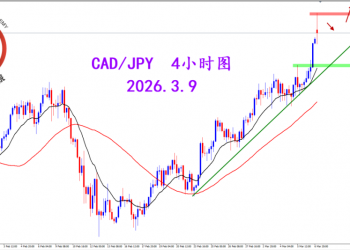

2026.3.9 图文交易计划:加日突破压制 多头303 人气#黄金外汇论坛

2026.3.9 图文交易计划:加日突破压制 多头303 人气#黄金外汇论坛 网纸「TL282.cc」腾龙公司游戏会员账号注册484 人气#美股论坛

网纸「TL282.cc」腾龙公司游戏会员账号注册484 人气#美股论坛 网纸「TL282.cc」腾龙公司注册游戏会员账号458 人气#美股论坛

网纸「TL282.cc」腾龙公司注册游戏会员账号458 人气#美股论坛 网纸「TL282.cc」腾龙怎么注册账号会员61 人气#游枷利叶 专栏

网纸「TL282.cc」腾龙怎么注册账号会员61 人气#游枷利叶 专栏