三重滤网交易系统更新版

三重滤网交易系统更新版

TRIPLE SCREEN UPDATE

One of the most pleasant encounters that occur several times each year is when a trader comes up to me at some conference and tells me how he started trading for a living after studying my book or participating in a Camp. At that point, he may be living and trading on a mountaintop, and as often as not he owns the mountaintop. I noticed long ago that half-way through our conversation these people become slightly apologetic. They tell me they use Triple Screen, but not exactly the way I taught it. They may have modified an indicator, added another screen, substituted a tool, and so forth. Whenever I hear that, I know I am talking to a winner.

First of all, I tell them they owe their success primarily to themselves. I did not teach them any differently than the dozens of others in the same class. Winners have the discipline to take what is offered and use it to succeed. Second, I see their apology for having changed some aspects of my system as an indication of their winning attitude. To benefit from a system, you must test its parameters and fine-tune them until that system becomes your own, even though originally it was developed by someone else. Winning takes discipline, discipline comes from confidence, and the only system in which you can have confidence is the one you have tested on your own data and adapted to your own style.

I developed the Triple Screen trading system in the mid-1980s and first presented it to the public in 1986 in an article in Futures magazine.

I updated it in Trading for a Living and several videos. Here I will review it, focusing on recent enhancements.

What is a trading system? What’s the difference between a method, a system, and a technique?

A method is a general philosophy of trading. For example; trade with the

trend, buy when the trend is up, and sell after it tops out. Or—buy

undervalued markets, go long near historical support levels, and sell

after resistance zones have been reached.

A system is a set of rules for implementing a method. For example, if our

method is to follow trends, then the system may buy when a multi-week

moving average turns up and sell when a daily moving average turns down (get in slow, get out fast). Or—buy when the weekly MACDHistogram

ticks up and sell after it ticks down.

A technique is a specific rule for entering or exiting trades. For example,

when a system gives a buy signal, the technique could be to buy when

prices exceed the high of the previous day or if prices make a new low during the day but close near the high.

The method of Triple Screen is to analyze markets in several timeframes

and use both the trend-following indicators and oscillators. We make a strategic decision to trade long or short using trend-following indicators on long-term charts. We make tactical decisions to enter or exit using oscillators on shorter-term charts. The original method has not changed, but the system—the exact choice of indicators—has evolved over the years, as have the techniques.

Triple Screen examines each potential trade using three screens or tests. Each screen uses a different timeframe and indicators. These screens filter out many trades that seem attractive at first. Triple Screen promotes a careful and cautious approach to trading.

Conflicting Indicators

Technical indicators help identify trends or turns more objectively than

chart patterns. Just keep in mind that when you change indicator

parameters, you influence their signals. Be careful not to fiddle with

indicators until they tell you what you want to hear.

We can divide all indicators into three major groups:

Trend-following indicators help identify trends. Moving averages,

MACD lines, Directional system, and others rise when the markets are

rising, decline when markets fall, and go flat when markets enter trading

ranges.

Oscillators help catch turning points by identifying overbought and

oversold conditions. Envelopes or channels, Force Index, Stochastic,

Elder-ray, and others show when rallies or declines outrun themselves

and are ready to reverse.

Miscellaneous indicators help gauge the mood of the market crowd.

Bullish Consensus, Commitments of Traders, New High–New Low Index,

and others reflect the general levels of bullishness or bearishness in

the market.

Different groups of indicators often give conflicting signals. Trendfollowing

indicators may turn up, telling us to buy, while oscillators

become overbought, telling us to sell. Trend-following indicators may

turn down, giving sell signals, while oscillators become oversold, giving

buy signals. It is easy to fall into the trap of wishful thinking and

start following those indicators whose message you like. A trader must

set up a system that takes all groups of indicators into account and

handles their contradictions.

Conflicting Timeframes

An indicator can call an uptrend and a downtrend in the same stock on

the same day. How can this be? A moving average may rise on a weekly

chart, giving a buy signal, but fall on a daily chart, giving a sell signal.

It may rally on an hourly chart, telling us to go long, but sink on a 10-

minute chart, telling us to short. Which of those signals should we take?

Amateurs reach for the obvious. They grab a single timeframe, most

often daily, apply their indicators and ignore other timeframes. This

works only until a major move swells up from the weeklies or a sharp

spike erupts from the hourly charts and flips their trade upside down.

Whoever said that ignorance was bliss was not a trader.

People who have lost money with daily charts often imagine they

could do better by speeding things up and using live data. If you cannot

make money with dailies, a live screen will only help you lose

faster. Screens hypnotize losers, but a determined one can get even closer

to the market by renting a seat and going to trade on the floor. Pretty

soon a margin clerk for the clearing house notices that the new trader’s

equity has dropped below limit. He sends a runner into the pit who

taps that person on the shoulder. The loser steps out and is never seen

again—he has “tapped out.”

The problem with losers is not that their data is too slow, but their

decision-making process is a mess. To resolve the problem of conflicting

timeframes, you should not get your face closer to the market, but

push yourself further away, take a broad look at what’s happening,

make a strategic decision to be a bull or a bear, and only then return

closer to the market and look for entry and exit points. That’s what

Triple Screen is all about.

What is long term and what is short term? Triple Screen avoids rigid

definitions by focusing instead on the relationships between timeframes.

It requires you to begin by choosing your favorite timeframe,

which it calls intermediate. If you like to work with daily charts, your

intermediate timeframe is daily. If you are a day-trader and like fiveminute

charts, then your intermediate timeframe is the five-minute

chart, and so on.

Triple Screen defines the long term by multiplying the intermediate

timeframe by five (see “Time—The Factor of Five,” page 87). If your

intermediate timeframe is daily, then your long-term timeframe is weekly.

If your intermediate timeframe is five minutes, then your long-term is

half-hourly, and so forth. Choose your favorite timeframe, call it intermediate,

and immediately move up one order of magnitude to a

long-term chart. Make your strategic decision there, and return to the

intermediate chart to look for entries and exits.

The key principle of Triple Screen is to begin your analysis by stepping

back from the markets and looking at the big picture for strategic

decisions. Use a long-term chart to decide whether you are bullish or

bearish, and then return closer to the market to make tactical choices

about entries and exits.

第一套(用于中长线交易)

The Principles of Triple Screen

Triple Screen resolves contradictions between indicators and timeframes.

It reaches strategic decisions on long-term charts, using trendfollowing

indicators—this is the first screen. It proceeds to make

tactical decisions about entries and exits on the intermediate charts,

using oscillators—this is the second screen. It offers several methods

for placing buy and sell orders—this is the third screen, which we may

implement using either intermediate- or short-term charts.

Begin by choosing your favorite timeframe, the one with whose

charts you like to work, and call it intermediate. Multiply its length by

five to find your long-term timeframe. Apply trend-following indicators

to long-term charts to reach a strategic decision to go long, short, or

stand aside. Standing aside is a legitimate position. If the long-term

chart is bullish or bearish, return to the intermediate charts and use

oscillators to look for entry and exit points in the direction of the longterm

trend. Set stops and profit targets before switching to short-term

charts, if available, to fine-tune entries and exits.

SCREEN ONE

Choose your favorite timeframe and call it intermediate. Multiply it by

five to find the long-term timeframe. Let’s say you prefer to work with

daily charts. In that case, move immediately one level higher, to the

weekly chart. Do not permit yourself to peek at the dailies because this

may color your analysis of weekly charts. If you are a day-trader, you

might choose a 10-minute chart as your favorite, call it intermediate,

and then immediately move up to the hourly chart, approximately five

times longer. Rounding off is not a problem; technical analysis is a craft,

not an exact science. If you are a long-term investor, you might choose

a weekly chart as your favorite and then go up to the monthly.

Apply trend-following indicators to the long-term chart and make a

strategic decision to trade long, short, or stand aside. The original version

of Triple Screen used the slope of weekly MACD-Histogram as its

weekly trend-following indicator. It was very sensitive and gave many

buy and sell signals. I now prefer to use the slope of a weekly exponential

moving average as my main trend-following indicator on longterm

charts. When the weekly EMA rises, it confirms a bull move and

tells us to go long or stand aside. When it falls, it identifies a bear

move and tells us to go short or stand aside. I use a 26-week EMA,

which represents half a year of trading. You can test several different

lengths to see which tracks your market best, as you would with any

indicator.

I continue to plot weekly MACD-Histogram. When both EMA and

MACD-Histogram are in gear, they confirm a dynamic trend and encourage

you to trade larger positions. Divergences between weekly

MACD-Histogram and prices are the strongest signals in technical

analysis, which override the message of the EMA.

SCREEN TWO

Return to the intermediate chart and use oscillators to look for trading

opportunities in the direction of the long-term trend. When the weekly

trend is up, wait for daily oscillators to fall, giving buy signals. Buying

dips is safer than buying the crests of waves. If an oscillator gives a sell

signal while the weekly trend is up, you may use it to take profits on

long positions but not to sell short.

When the weekly trend is down, look for daily oscillators to rise,

giving sell signals. Shorting during upwaves is safer than selling new

lows. When daily oscillators give buy signals, you may use them to

take profits on shorts but not to buy. The choice of oscillators depends

on your trading style.

For conservative traders, choose a relatively slow oscillator, such as

daily MACD-Histogram or Stochastic, for the second screen. When the

weekly trend is up, look for daily MACD-Histogram to fall below zero

and tick up, or for Stochastic to fall to its lower reference line, giving

a buy signal.

Reverse these rules for shorting in bear markets. When trendfollowing

indicators point down on the weekly charts, but daily MACDHistogram

ticks down from above its zero line, or Stochastic rallies to

its upper reference line, they give sell signals.

A conservative approach works best during early stages of major

moves, when markets gather speed slowly. As the trend accelerates,

pullbacks become more shallow. To hop aboard a fast-running trend,

you need faster oscillators.

For active traders, use the two-day EMA of Force Index (or longer,

if that’s what your research suggests for your market). When the

weekly trend is up and daily Force Index falls below zero, it flags a

buying opportunity.

Reverse these rules for shorting in bear markets. When the weekly

trend is down and the two-day EMA of Force Index rallies above zero,

it points to shorting opportunities.

Many other indicators can work with Triple Screen. The first screen

can also use Directional System or trendlines. The second screen can

use Momentum, Relative Strength Index, Elder-ray, and others.

The second screen is where we set profit targets and stops and make

a go–no go decision about every trade after weighing the level of risk

against the potential gain.

Set the stops. A stop is a safety net, which limits the damage from any

bad trade. You have to structure your trading in such a way that no

single bad loss, or a nasty series of losses, can damage your account.

Stops are essential for success, but many traders shun them. Beginners

complain about getting whipsawed, stopped out of trades that eventually

would have made them money. Some say that putting in a stop

means asking for trouble because no matter where you put it, it will

be hit.

First of all, you need to place stops where they are not likely to be

hit, outside of the range of market noise (see SafeZone on page 173).

Second, an occasional whipsaw is the price of long-term safety. No

matter how great your analytic skills, stops are always necessary.

You should move stops only one way—in the direction of the trade.

When a trade starts moving in your favor, move your stop to a breakeven

level. As the move persists, continue to move your stop, protecting

some of your paper profit. A professional trader never lets a profit

turn into a loss.

A stop may never expose more than 2% of your equity to the risk of

loss (see Chapter 7, “Money Management Formulas”). If Triple Screen

flags a trade but you realize that a logical stop would risk more than

2% of your equity, skip that trade.

Set profit targets. Profit targets are flexible and depend on your goals

and capital. If you are a well-capitalized, long-term-oriented trader, you

may build up a large position at an early stage of a bull market, repeatedly

taking buy signals from the daily charts, as long as the weekly

trend is up. Take your profits after the weekly EMA turns flat. The reverse

applies to downtrends.

Another option is to take profits whenever prices on the daily

charts hit their channel line. If you go long, sell when prices hit the

upper channel line and look to reposition on the next pullback to the

daily moving average. If you go short, cover when prices fall to their

lower channel line and look to reposition short on the next rally to

the EMA.

A short-term-oriented trader can use the signals of a two-day EMA

of Force Index to exit trades. If you buy in an uptrend when the twoday

EMA of Force Index turns negative, sell when it turns positive. If

you go short in a downtrend after the two-day EMA of Force Index

turns positive, cover when it turns negative.

Beginners often approach markets like a lottery—buy a ticket and sit

in front of the TV to find out whether you have won. You will know

that you are becoming a professional when you start spending almost

as much time thinking about exits as looking for entries.

SCREEN THREE

The third screen helps us pinpoint entry points. Live data can help savvy

traders but hurt beginners who may slip into day-trading.

Use an intraday breakout or pullback to enter trades without realtime

data. When the first two screens give you a buy signal (the weekly

is up, but the daily is down), place a buy order at the high of the previous

day or a tick higher. A tick is the smallest price fluctuation permitted

in any market. We expect the major uptrend to reassert itself and

catch a breakout in its direction. Place a buy order, good for one day

only. If prices break out above the previous day’s high, you will be

stopped in automatically. You do not have to watch prices intraday,

just give your order to a broker.

When the first two screens tell you to sell short (the weekly is down,

but the daily is up), place a sell order at the previous day’s low or a

tick lower. We expect the downtrend to reassert itself, and try to catch

the downside breakout. If prices break below the previous day’s low,

they will trigger your entry.

Daily ranges can be very wide, and placing an order to buy at the

top can be expensive. Another option is to buy below the market. If

you are trying to buy a pullback to the EMA, calculate where that EMA

is likely to be tomorrow and place your order at that level. Alternatively,

use the SafeZone indicator (see page 173) to find how far the market is

likely to dip below its previous day’s low and place your order at that

level. Reverse these approaches for shorting in downtrends.

The advantage of buying upside breakouts is that you follow an

impulse move. The disadvantage is that you buy high and your stop is

far away. The advantage of bottom fishing is that you get your goods

on sale and your stop is closer. The disadvantage is the risk of getting

caught in a downside reversal. A “breakout entry” is more reliable, but

profits are smaller; a “bottom-fishing entry” is riskier, but the profits are

greater. Make sure to test both methods in your markets.

Use real-time data, if available, for entering trades. When the first

two screens give you a buy signal (the weekly is up, but the daily is

down), use live data to get long. You could follow a breakout from

the opening range, when prices rally above the high of the first 15 to

30 minutes of trading, or apply technical analysis to intraday charts

and finesse your entry. When trying to short, you may enter on a

downside breakout from the opening range. You could also monitor

the market intraday and use technical analysis to enter into a short

trade, using live charts.

The techniques for finding buy and sell signals on real-time charts are

the same as on daily charts, only their speed is much higher. If you use

weeklies and dailies to get in, use them also to get out. Once a live chart

gives an entry signal, avoid the temptation to exit using intraday data.

Do not forget that you entered that trade on the basis of weekly and

daily charts, expecting to hold for several days. Do not be distracted by

the intraday chop if you are trading swings that last several days |

2025.12.16 图文交易计划:布油开放下行 关2381 人气#黄金外汇论坛

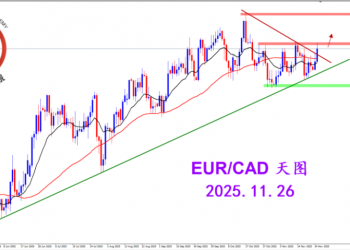

2025.12.16 图文交易计划:布油开放下行 关2381 人气#黄金外汇论坛 2025.11.26 图文交易计划:欧加试探拉升 关3113 人气#黄金外汇论坛

2025.11.26 图文交易计划:欧加试探拉升 关3113 人气#黄金外汇论坛 MQL5全球十大量化排行榜3158 人气#黄金外汇论坛

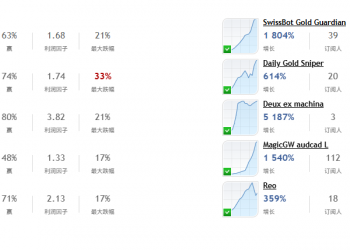

MQL5全球十大量化排行榜3158 人气#黄金外汇论坛 【认知】5966 人气#黄金外汇论坛

【认知】5966 人气#黄金外汇论坛